- Toncoin dropped by 24% recently, but analysts project a potential 280% surge in the current bull cycle.

- Key metrics like whale transactions and Open Interest provide insight into Toncoin’s near-term price trajectory.

Toncoin [TON] has been navigating a challenging period following a series of impressive performances earlier this year. The cryptocurrency, which reached an all-time high (ATH) of $8.25 in June, has since seen its price steadily decline.

At the time of writing, TON was trading at $5.23, reflecting a 36.3% decrease from its ATH and a 24% drop over the past two weeks. This downward trend highlights the volatility in the crypto market, even for assets with a strong track record.

Amid these price movements, market analysts remain optimistic about Toncoin’s potential in the ongoing bull run. For instance, a CryptoQuant analyst, Burak Kesmeci, has highlighted the possibility of a significant upside for TON based on the SMA365 Heatmap metric.

According to Kesmeci, the current price level of $5.14 marks a “cool zone,” historically associated with local bottoms during bull cycles. This analysis positions TON for potential upward movement as market conditions stabilize.

Price heatmap and Toncoin bullish targets

Kesmeci’s analysis identifies three potential price targets for Toncoin: $8.74, $15.93, and $19.53. These levels are derived from the SMA365 Heatmap, which uses moving averages to project price trends.

These target levels may rise further during a bull market as prices gain momentum. The analyst suggests that TON could experience a surge of up to 280% in an altcoin-driven bull market.

While these projections are encouraging, they highlight the importance of closely monitoring market dynamics.

Source: CryptoQuant

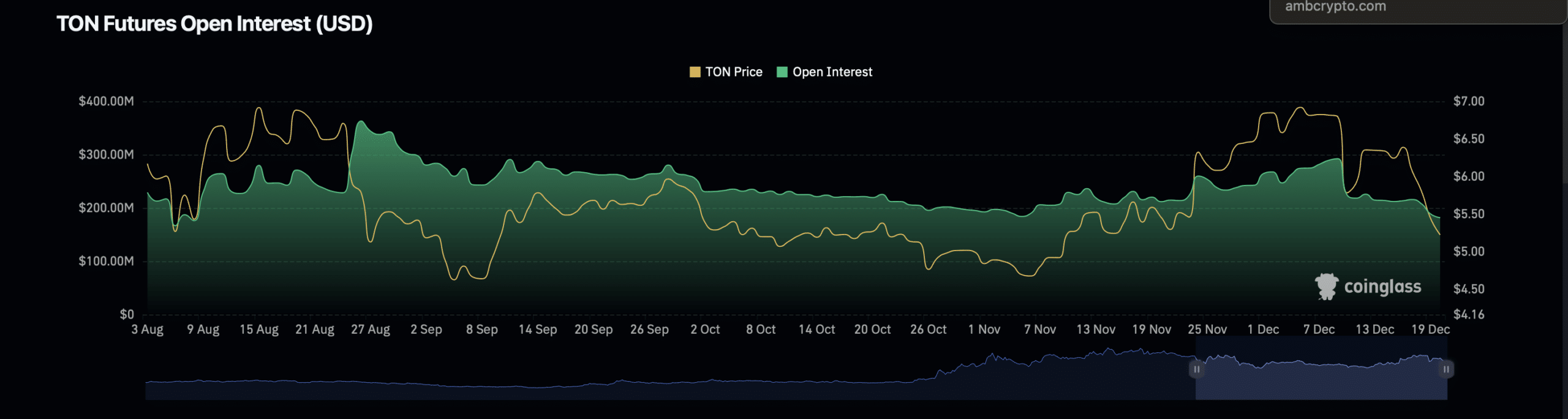

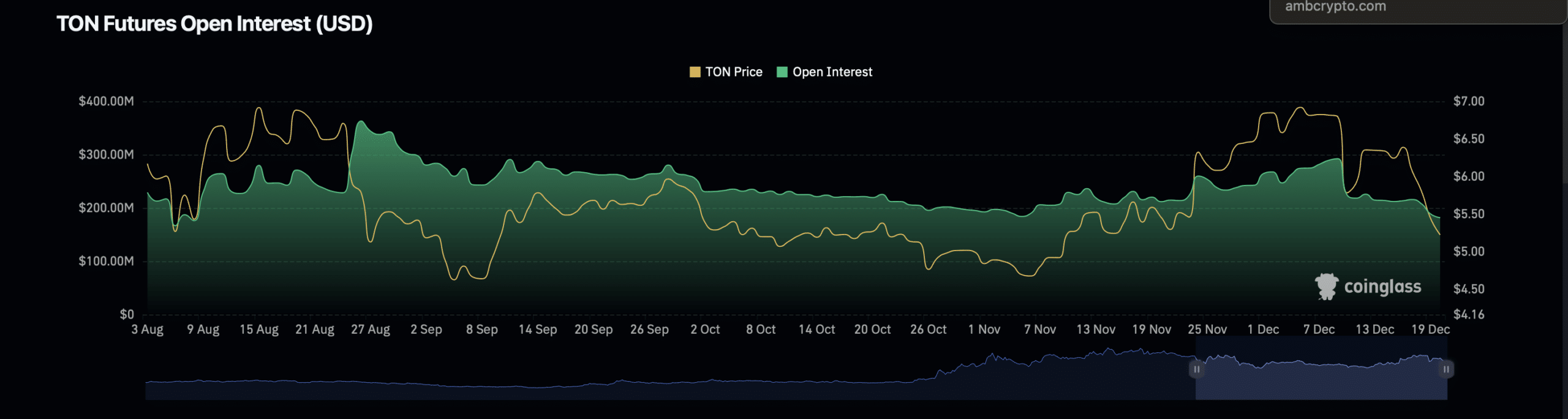

Beyond the price heatmap, other key metrics offer insights into Toncoin’s near-term trajectory. Open Interest(OI) data from Coinglass shows a 1.50% decline, bringing the current valuation to $182.96 million.

Source: Coinglass

Meanwhile, TON’s OI volume has increased by 11.37%, reaching $342.66 million. This mixed performance in derivatives markets suggests cautious investor sentiment, potentially influenced by recent price volatility.

Whale activity and market implications

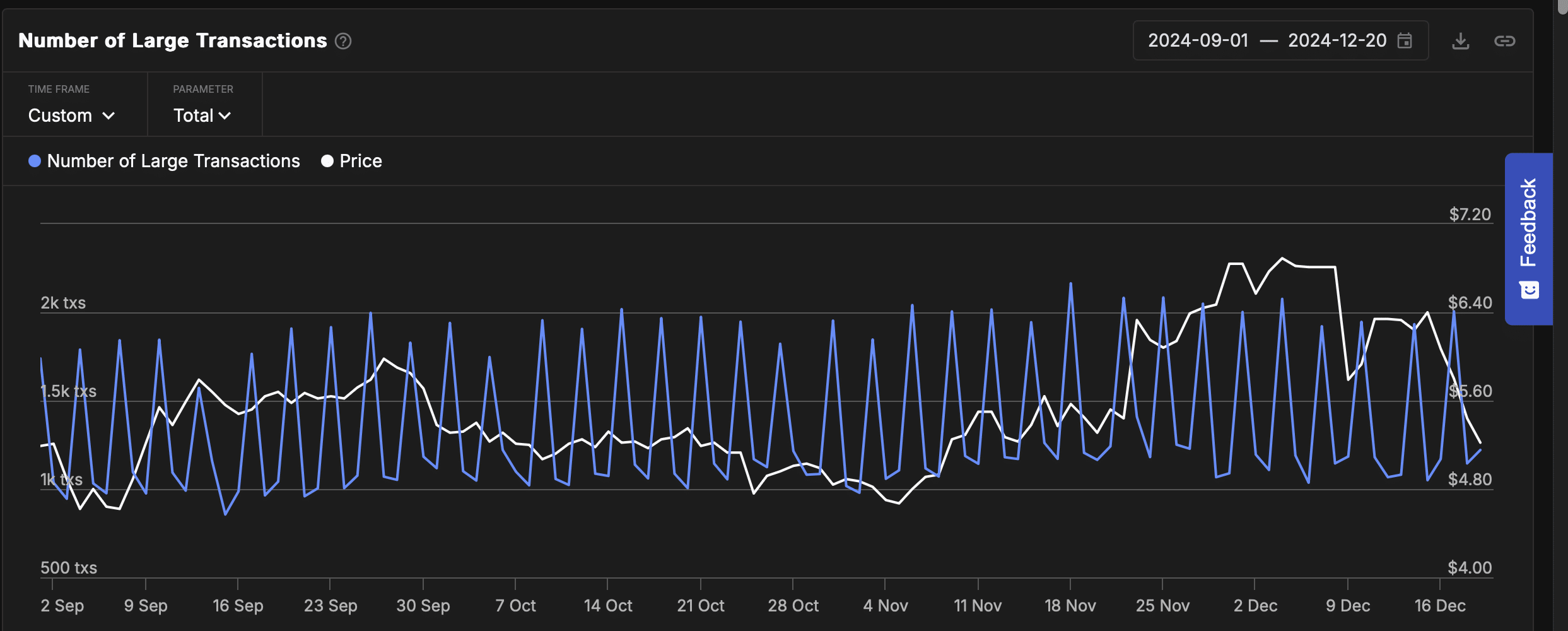

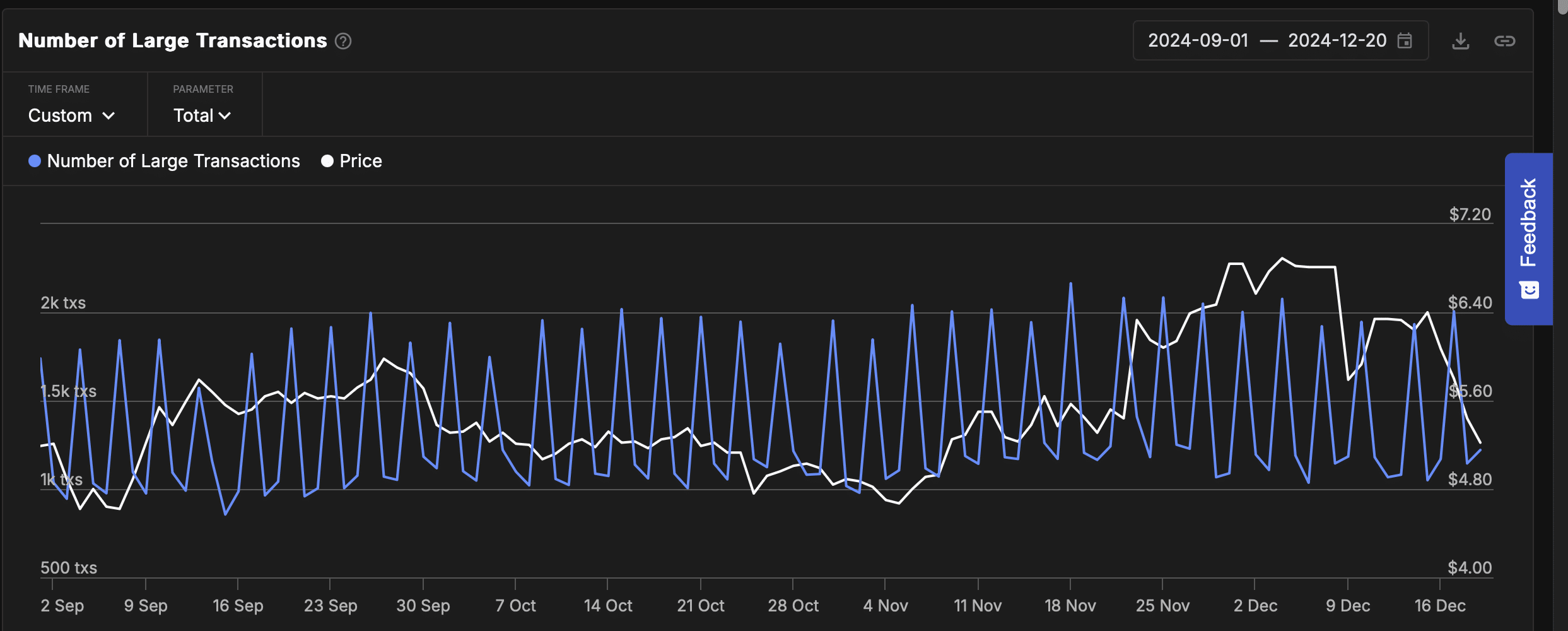

Another critical factor in TON’s price outlook is whale transaction activity, which provides a snapshot of large-scale investor behavior. According to data from IntoTheBlock, TON’s whale transactions have dropped significantly, from over 2,000 transactions on the 17 the of December to approximately 1,220 as of the 19th of December.

Source: IntoTheBlock

This decline shows reduced activity from high-net-worth investors, indicating diminished buying pressure or profit-taking at current levels. A decrease in whale transactions can have mixed implications for Toncoin’s price.

Read Toncoin’s [TON] Price Prediction 2024–2025

On the one hand, lower whale activity may reduce sudden market fluctuations caused by large trades. On the other hand, sustained inactivity from this segment could indicate a lack of confidence in short-term price growth.

As a result, the market may experience periods of consolidation before the next significant move.