- UNI’s price formed a bullish triangle, indicating potential for a significant breakout

- Bullish on-chain metrics and growing long sentiment hinted at strong upward movement

Uniswap’s [UNI] dominance in the decentralized exchange (DEX) market continues to grow, with its network activity surging from 36.8% to an impressive 91.3% in 2024. This remarkable growth has attracted over 45.3 million users, solidifying its position as the leading DEX for user acquisition.

Meanwhile, a whale’s recent $1.42 million USDC purchase of 100,000 UNI at $14.24 highlighted strong investor confidence. At press time, UNI was trading at $13.07, with the altcoin down by 4.07% and key price levels likely to dictate its next direction.

Key levels to watch for a breakout

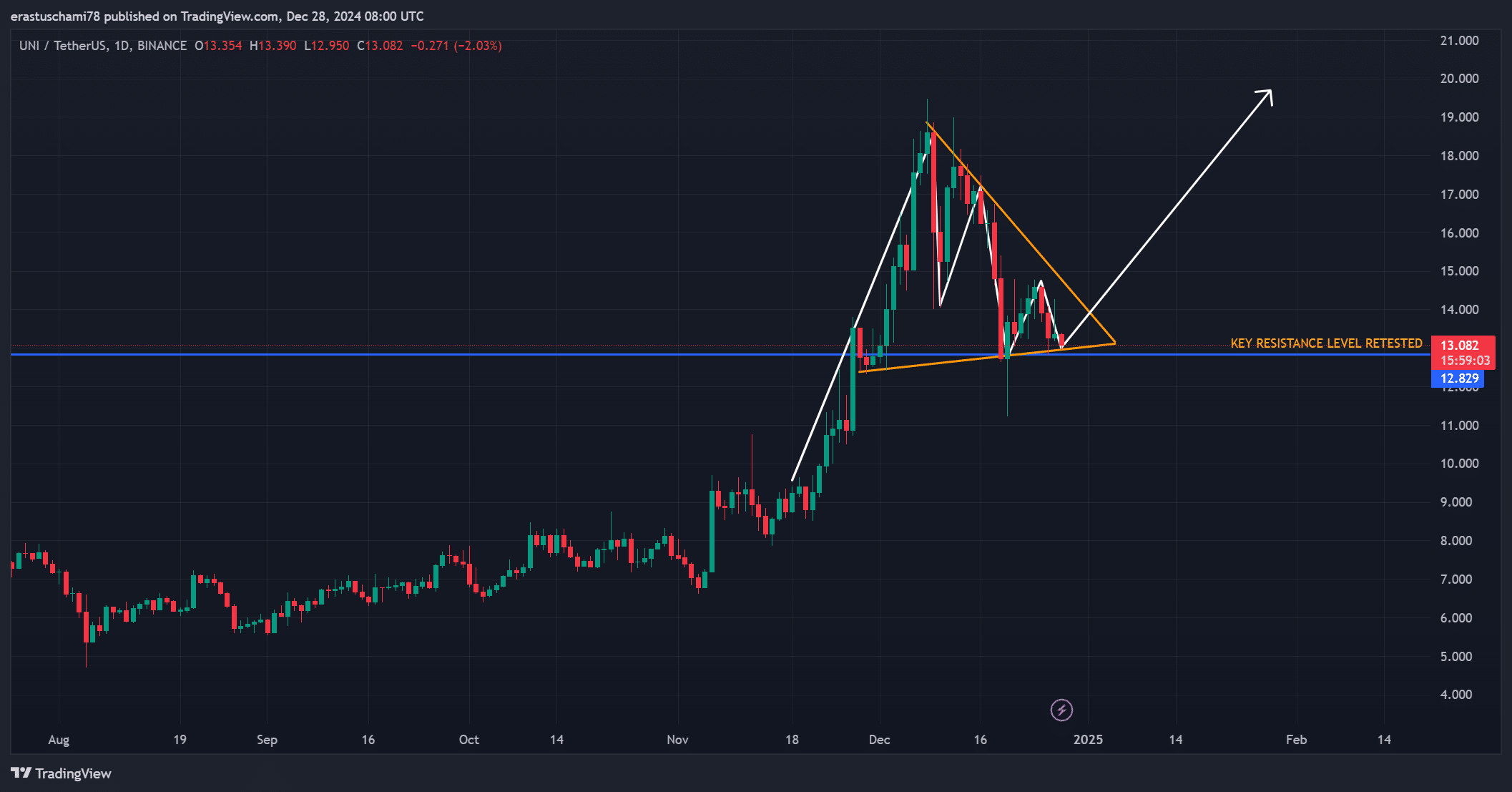

UNI’s price chart highlighted the potential for a major breakout, as a symmetrical triangle pattern formed. Such a structure often signals a significant move, and the retest of the $12 resistance level added to bullish possibilities.

A breakout above this level could propel UNI towards $20 or higher, generating substantial upside for traders. However, recent selling pressure on the chart underlined the importance of sustained buying momentum.

Source: TradingView

What do metrics reveal about network activity?

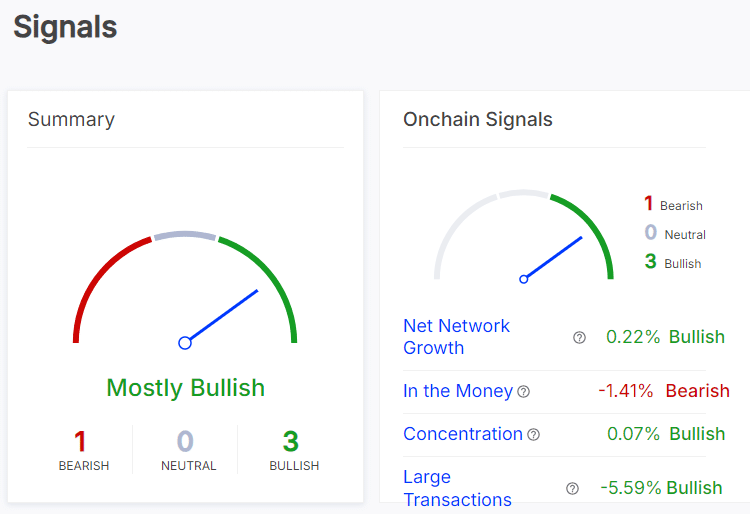

On-chain metrics pointed to a mostly bullish outlook for UNI. Net network growth rose by 0.22%, indicating an influx of new users. Additionally, whale activity has remained consistent, with the concentration increasing by 0.07%.

However, the “In the Money” metric declined by -1.41%, pointing to profit-taking behavior among some holders. Large transactions dropped by -5.59%, signaling short-term caution. These mixed signals highlighted the importance of monitoring whale movements and broader market sentiment to gauge UNI’s trajectory.

Source: IntoTheBlock

UNI exchange reserve analysis

The exchange reserves saw a modest hike of 0.21%, bringing the total to 70.22 million tokens. While this could allude to slight selling pressure, the low rate of increase suggested that most holders have been maintaining their positions.

This seemed to be in line with the overall market retracement, though a significant spike in reserves might signal bearish intent.

Source: CryptoQuant

Building momentum or losing steam?

Technical indicators lent further insights into Uniswap’s press time state. The Average Directional Index (ADX) at 26.77 underlined moderate trend strength. Meanwhile, the 9-day moving average was below the 21-day MA, pointing to near-term bearishness.

However, the symmetrical triangle highlighted that a bullish crossover may soon ignite renewed buying interest.

Source: TradingView

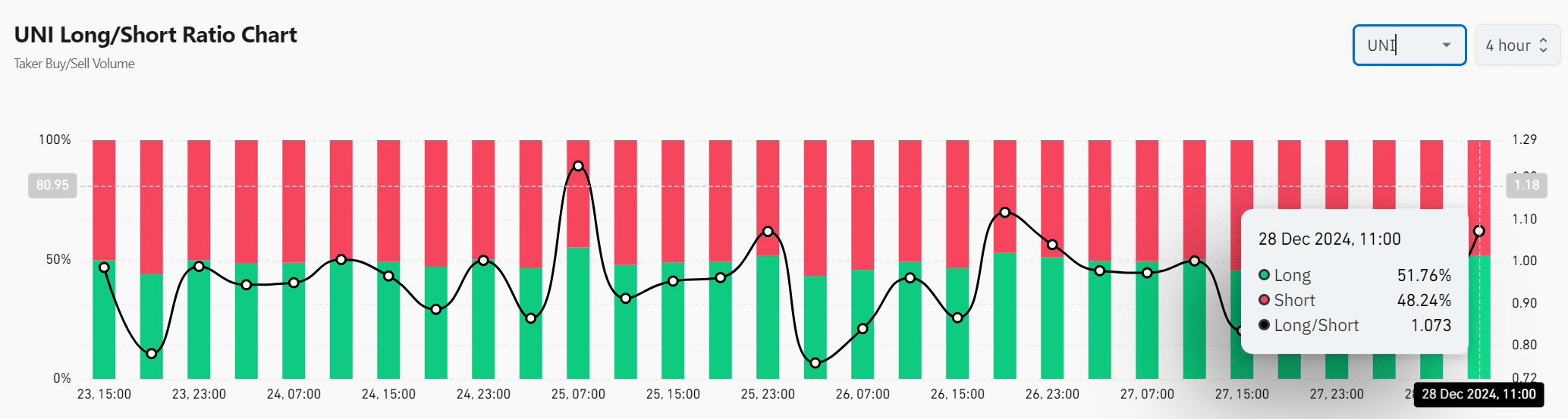

Long/short ratio – Is the market leaning bullish?

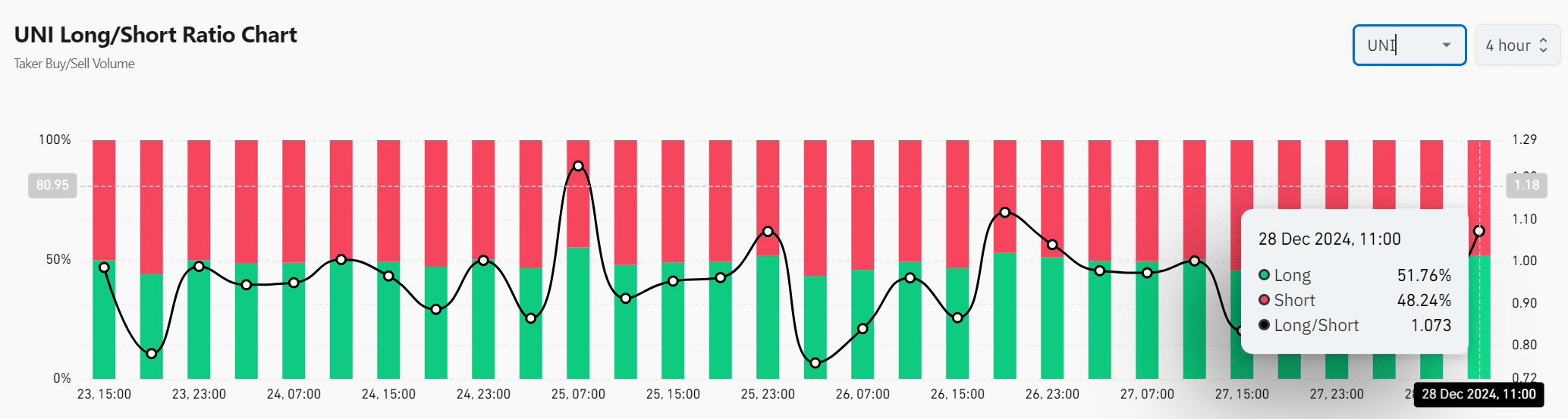

The long/short ratio for UNI stood at 1.073 at press time, with 51.76% of taker volume favoring longs. This growing bullish sentiment suggested that traders are positioning for a potential breakout. Additionally, the shift towards long positions aligned with broader expectations of upward price action.

However, maintaining this sentiment will depend on UNI’s ability to surpass critical resistance levels and sustain momentum in the coming sessions.

Source: Coinglass

Read Uniswap’s [UNI] Price Prediction 2025–2026

Is Uniswap primed for a breakout?

UNI’s charts flashed signs of strong potential for a breakout, supported by bullish on-chain signals and technical patterns.

If UNI can decisively break above $14, it is likely to rally towards $20, cementing its strength in the DeFi market. Therefore, UNI may be primed for a significant upward move, especially if key metrics and market sentiment align favourably.