- ONDO hiked and broke out of descending channel despite whale exits

- Retail traders stabilizes ONDO as technical indicators highlighted bullish momentum

A major whale has disrupted the ONDO market by selling 10.97M ONDO for $13.57M USDC, incurring a massive $3.8M loss after just three months of holding. This sell-off followed the whale’s prior accumulation of ONDO by trading 4,610.74 stETH valued at $17.38M.

At press time, ONDO was trading at $1.36, following a 9.65% hike in the last 24 hours. Needless to say though, the aforementioned sell-off has raised doubts about whether it can sustain its recovery and restore market confidence or not.

Has ONDO broken free from its slump?

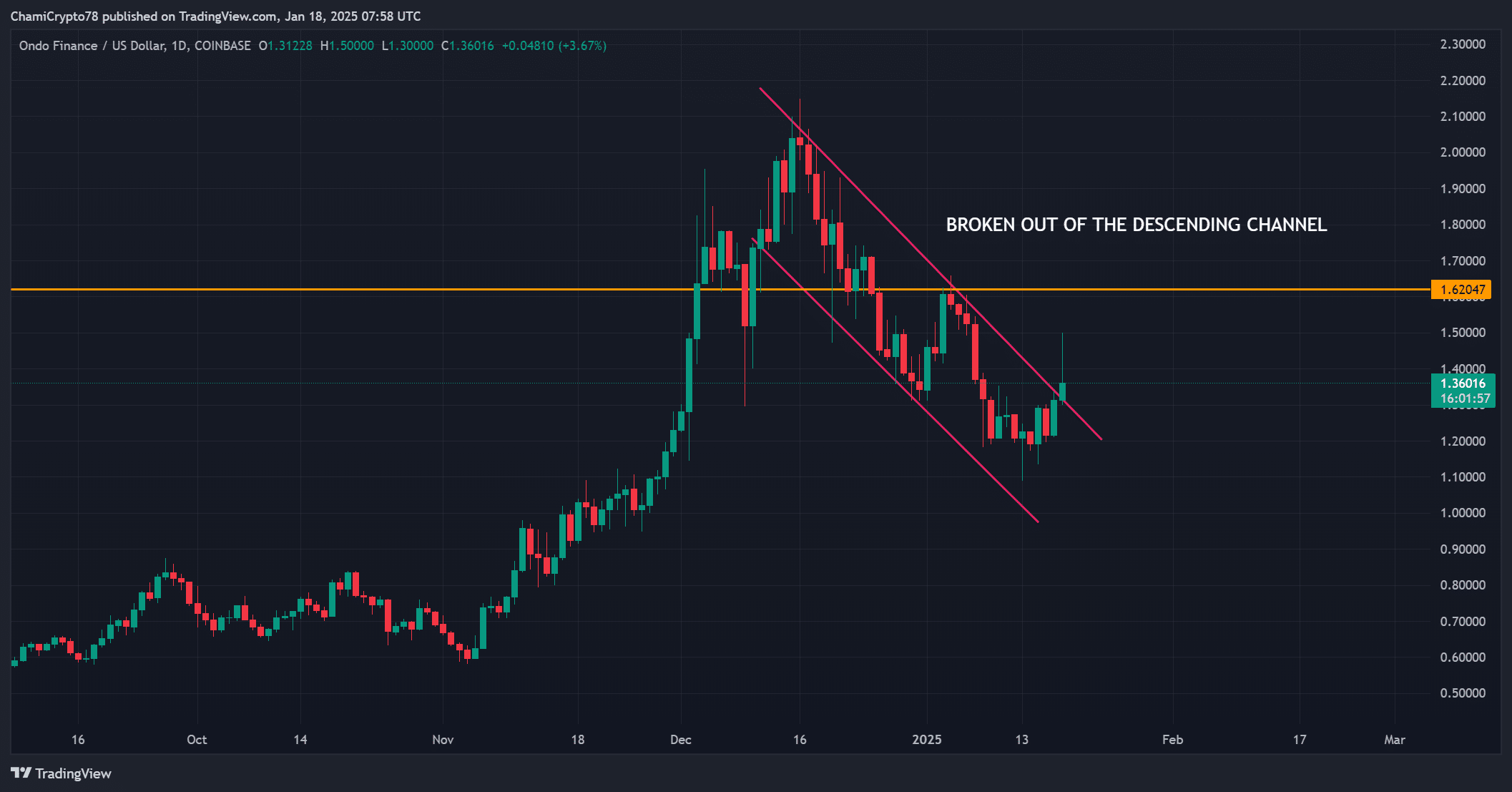

The altcoin’s price action revealed some encouraging signs, with the token breaking out of a descending channel that suppressed its growth for weeks. After rebounding from a low of $1.10, ONDO is now targeting the critical resistance level at $1.62.

This key level has historically acted as a strong hurdle for bulls. However, ONDO is still far below its recent peak of $2.20, leaving room for skepticism. Can the token maintain its upward trajectory and test new highs?

Source: TradingView

Technical indicators point to a bullish shift

At the time of writing, the Stochastic RSI seemed to be signaling bullish momentum, with the %K line at 58.87 crossing above the %D line at 42.84 – A sign of growing buying pressure. Additionally, the indicator’s uptrend suggested that the token may soon hit overbought territory.

The Parabolic SAR confirmed this optimism, with dotted markers forming below the price action, starting at $1.10. This highlighted a potential reversal to an uptrend. However, failure to clear $1.62 could trigger renewed selling pressure, tempering this bullish outlook.

Source: TradingView

ONDO’s network activity – Growth or uncertainty?

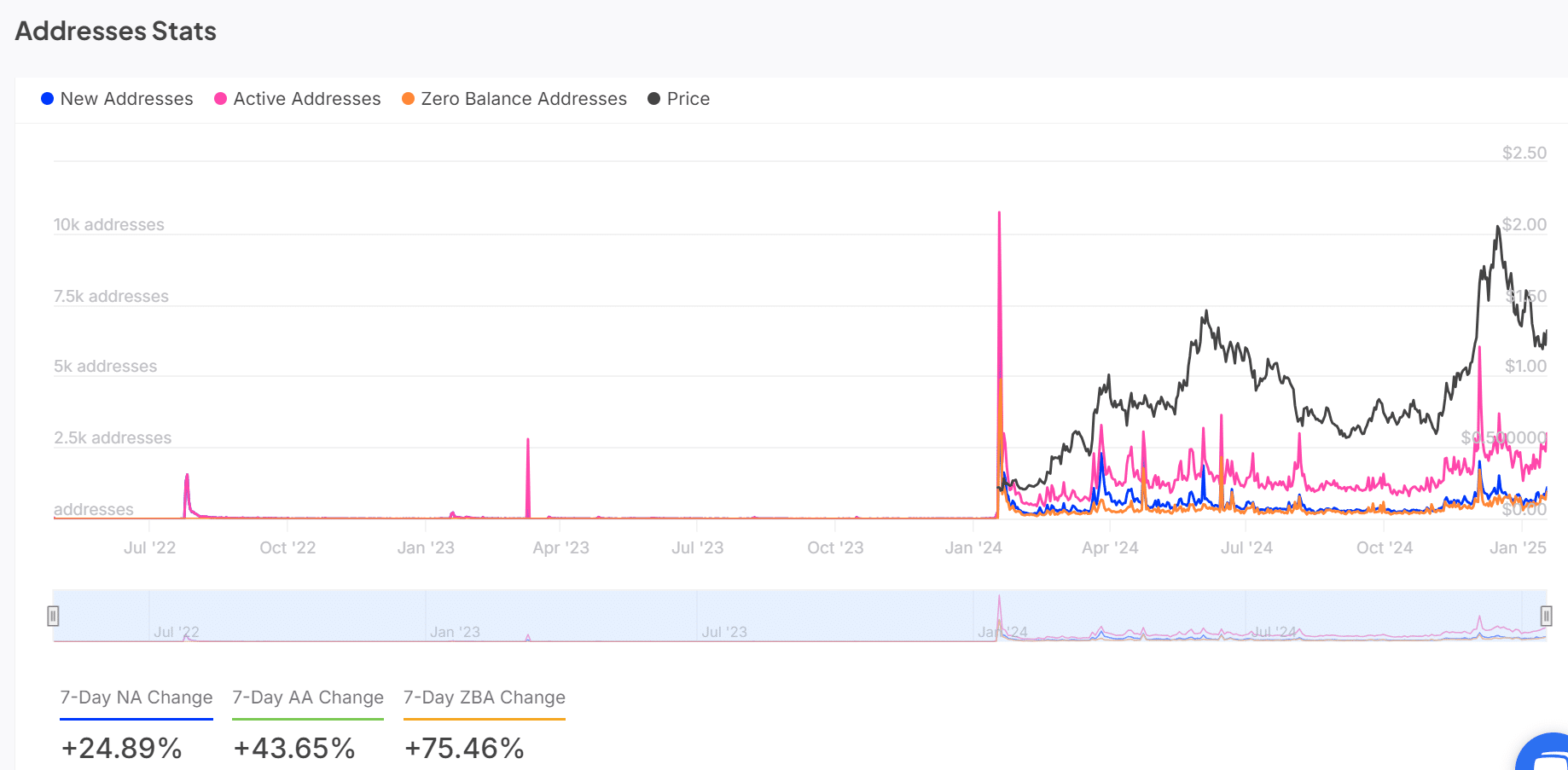

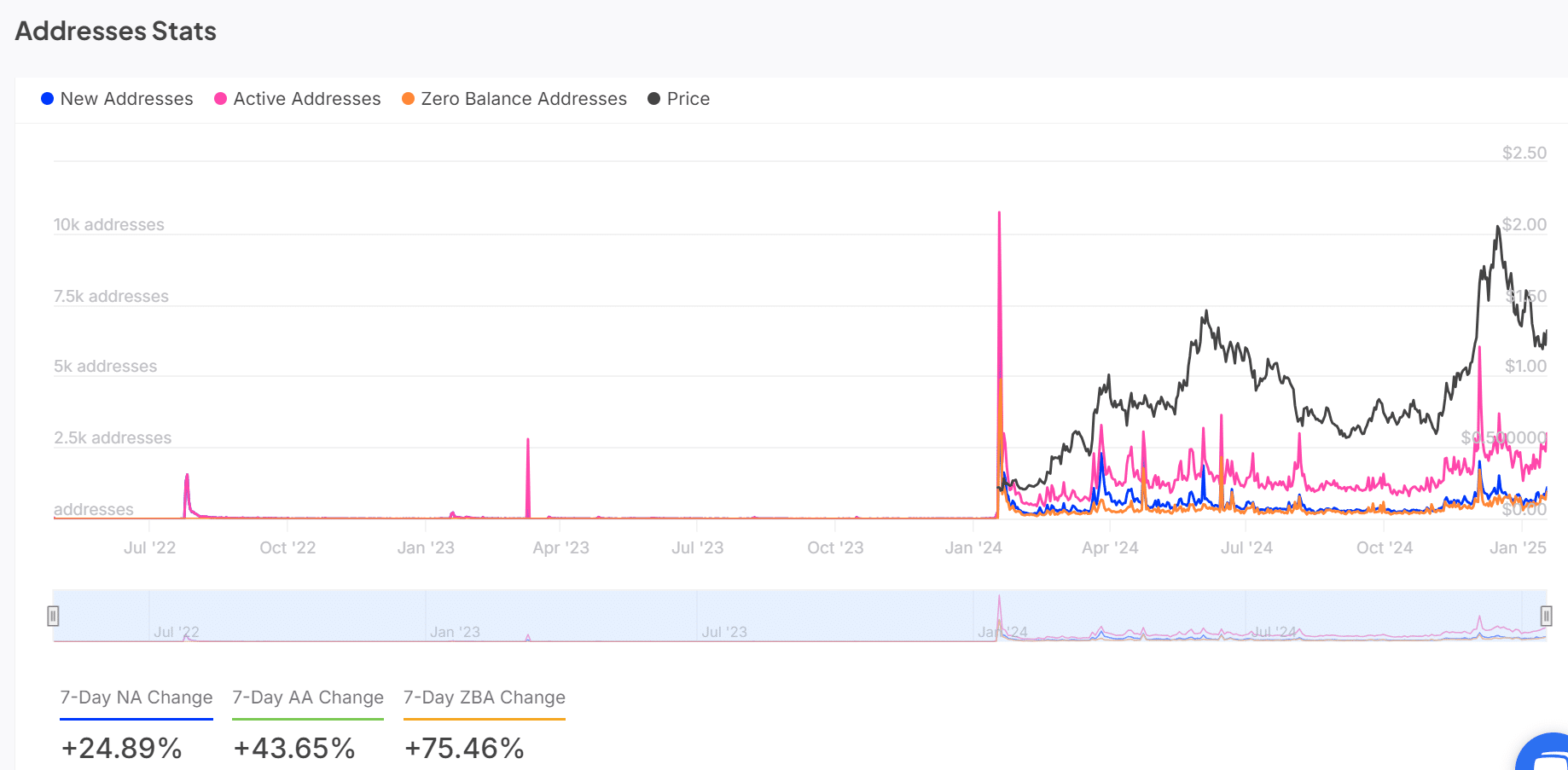

Network activity data revealed a mixed sentiment among investors. Active addresses rose by 43.65% over the past week, while new addresses hiked by 24.89%, reflecting a hike in interest.

However, zero-balance addresses have surged by 75.46%, signaling that many investors may be exiting their positions. This dynamic means that while ONDO has been attracting new participants, lingering concerns about its long-term prospects remain prevalent.

Source: IntoTheBlock

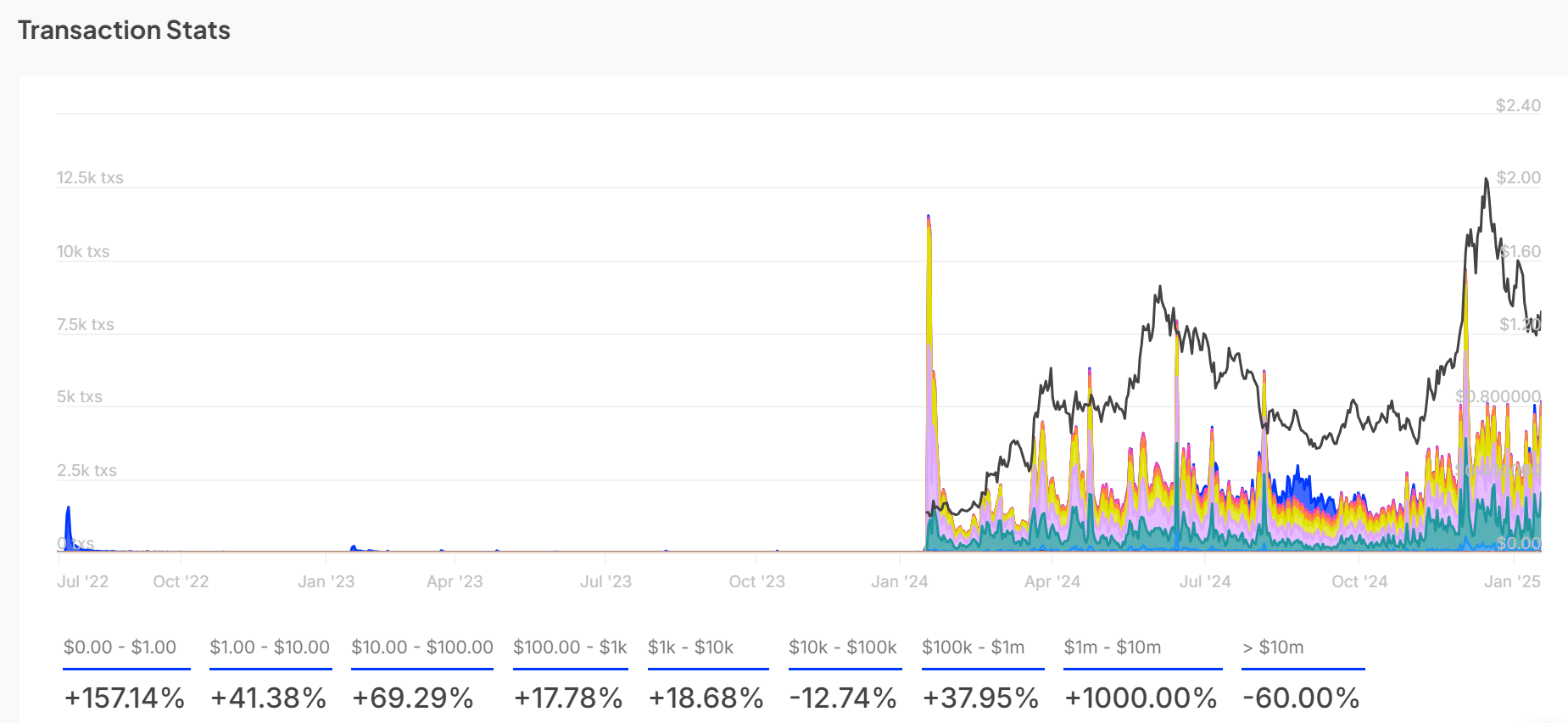

Transactions reveal a retail-driven recovery

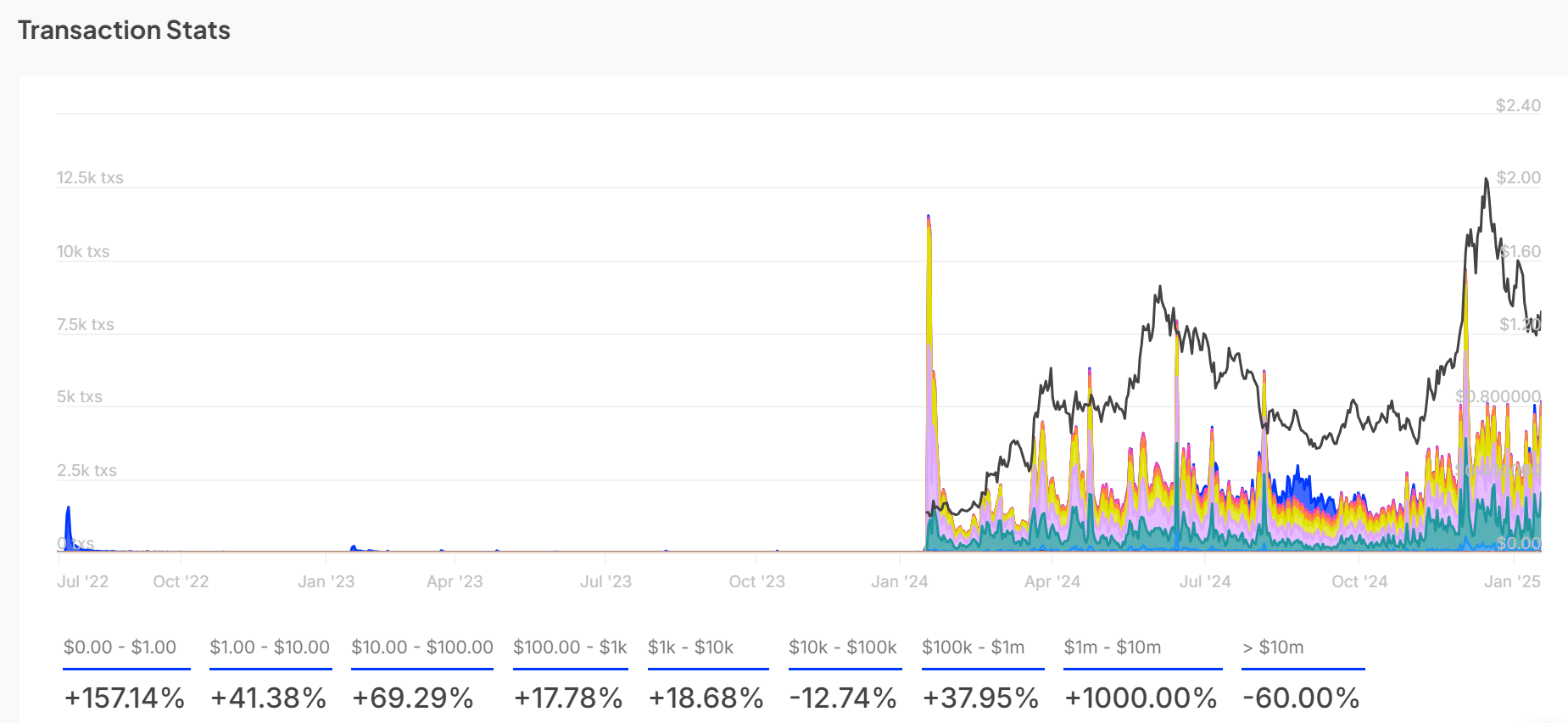

Transaction stats highlighted a shift in market dynamics, with retail traders stepping in as whales retreat. Transactions below $10M surged by 69.29%, while large transactions exceeding $10M dropped by 60%.

This trend indicated that smaller investors have been providing critical support for ONDO’s price action. However, the absence of whale activity may limit its ability to stage a stronger recovery without significant capital inflows.

Source: IntoTheBlock

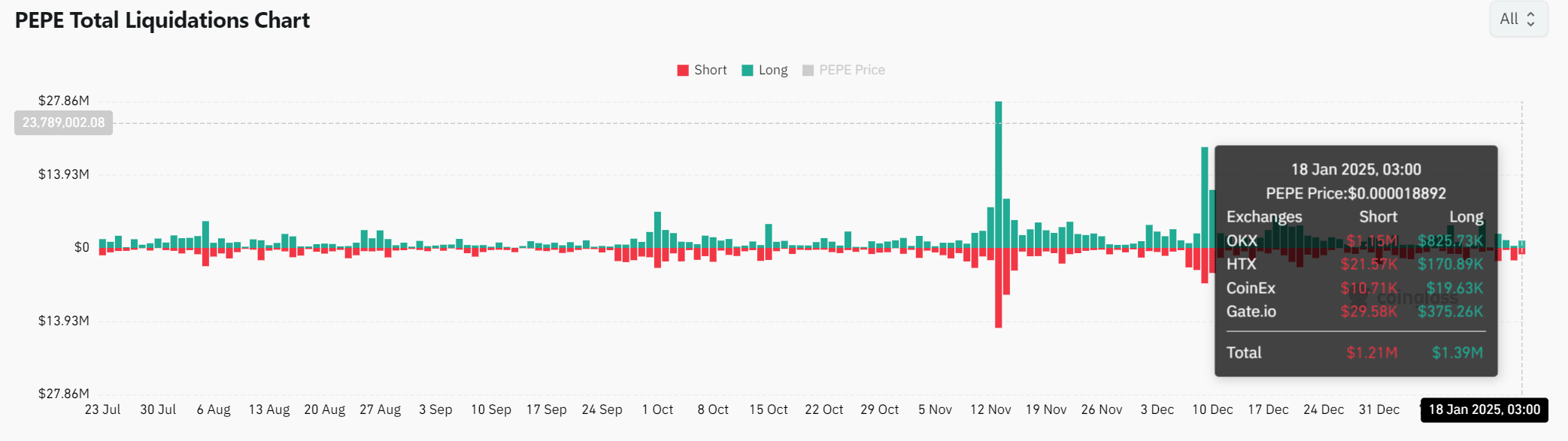

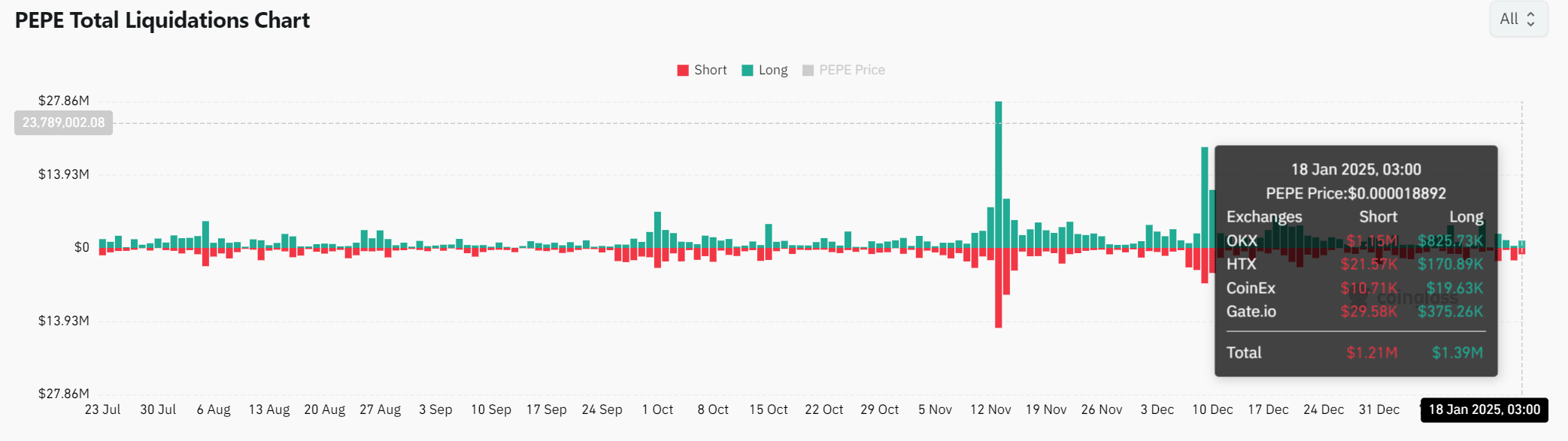

Is ONDO safe from liquidation shocks?

Liquidation data suggested that the token has so far avoided major shocks, despite the whale’s exit. Both long and short liquidations remained minimal compared to other tokens – Reflecting a relatively stable market response.

However, future volatility cannot be ruled out. Especially if additional large holders decide to exit their positions. This calm before the storm may be short-lived if investor sentiment falters.

Source: Coinglass

Read Ondo Finance’s [ONDO] Price Prediction 2025–2026

ONDO’s breakout from the descending channel, coupled with rising retail interest, offers reasons for cautious optimism.

However, the absence of whale activity and resistance at $1.62 poses significant challenges to its recovery. Therefore, its ability to bounce back hinges on overcoming resistance levels and attracting consistent investor confidence in the coming weeks.