- Whales have been accumulating ADA, purchasing significant amounts over the past 24 hours.

- Derivative traders could drive the next phase of ADA’s movement, as bullish sentiment dominated this group.

ADA slipped 2.84% in the last 24 hours despite positive sentiment. Still, the asset holds onto a 4.59% weekly gain and an impressive 47.55% increase over the past month.

The combination of rising investor activity and a shrinking supply of ADA on exchanges could set the stage for a price reversal, pushing the asset to higher levels.

Whales buy ADA in bulk

According to crypto analyst Ali Chart, citing data from Santiment, there has been significant buying activity from ADA whales—large investors capable of influencing market movements.

These whales control over 1% of ADA’s circulating supply.

In the past 24 hours, whales conducted 687 transactions involving over $1 million worth of ADA. This spike in activity suggests increased accumulation by major holders, a positive indicator for the asset’s outlook.

Source: X

To verify this trend, AMBCrypto examined additional market metrics to determine whether this accumulation aligns with broader bullish signals for ADA.

Balance between bulls and bears

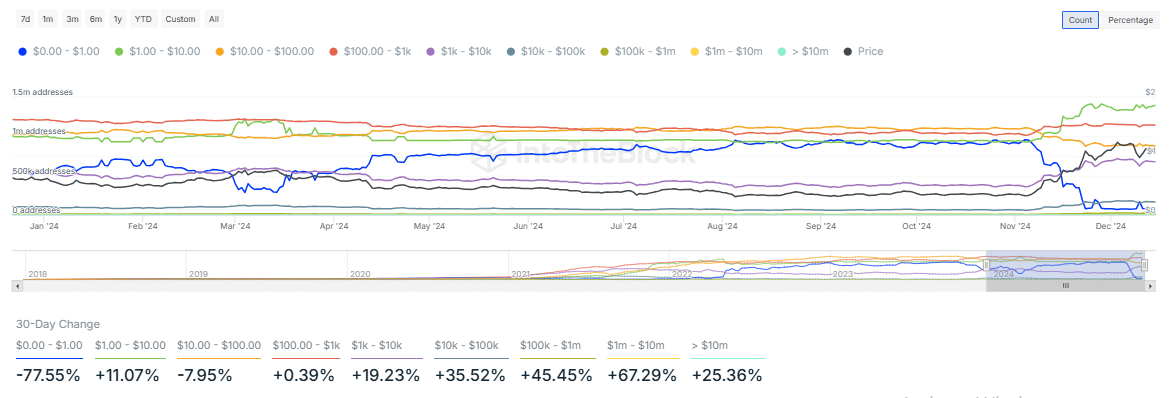

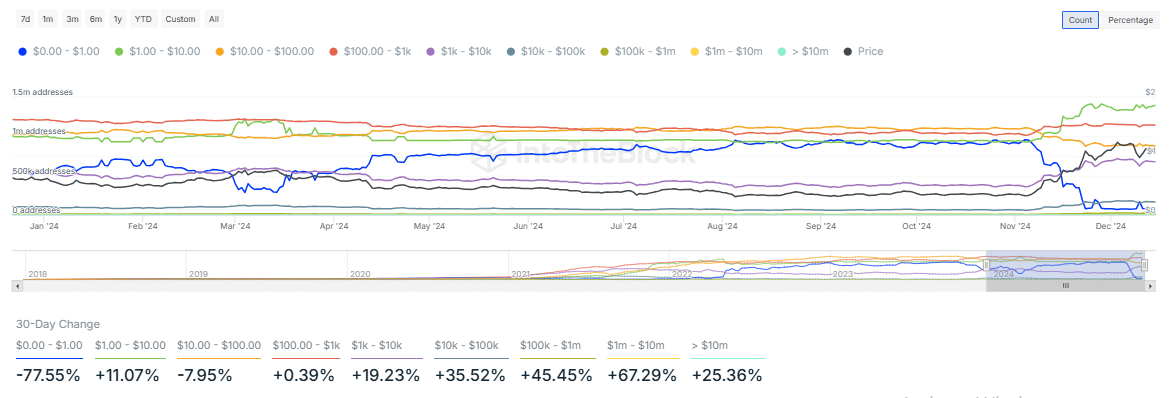

AMBCrypto has confirmed a significant surge in buying activity across various trader cohorts, categorized by their holdings.

Over the past 30 days, addresses holding between $1 million and $10 million worth of ADA have increased by 67.29%, marking the most notable rise compared to other addresses.

This further validates the heightened buying activity from whales in the market.

Source: IntoTheBlock

Despite this uptick, the market currently reflects a balance between bulls and bears, leaving ADA in a state of equilibrium.

Data from IntoTheBlock highlights an equal distribution of activity among major traders, with 95 bulls and 95 bears among the top 1% of participants.

This balance indicates a lack of decisive momentum, suggesting the drive to push ADA’s price higher may need to come from other trader cohorts.

AMBCrypto also analyzed derivative market activity, where signs of optimism are beginning to emerge.

Demand surge for ADA builds

Press-time data indicates a rising demand for ADA over the past 24 hours. Open Interest has increased by 5.43%, pushing its value to $908.24 million.

This uptick in Open Interest shows a surge in unsettled derivative contracts, driven primarily by long traders—a bullish signal for ADA’s short-term outlook.

Additionally, ADA recorded its largest single-day Exchange Netflow in six days, with a substantial netflow of $21.25 million.

Such major withdrawals often suggest that traders are moving assets off exchanges to hold for long-term gains, rather than selling.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2024–2025

If this trend continues—marked by rising Open Interest and long positions, coupled with sustained accumulation from large investors—ADA could experience a notable turnaround.

The altcoin could, as a result, surge to higher levels.