- RENDER saw massive whale interest, signaling a market rebound.

- Whales had huge market influence and owned nearly 92% of RENDER’s supply.

Render network [RENDER] has seen remarkable growth on price charts and increased whale interest amid AI and DeFi’s resurgence.

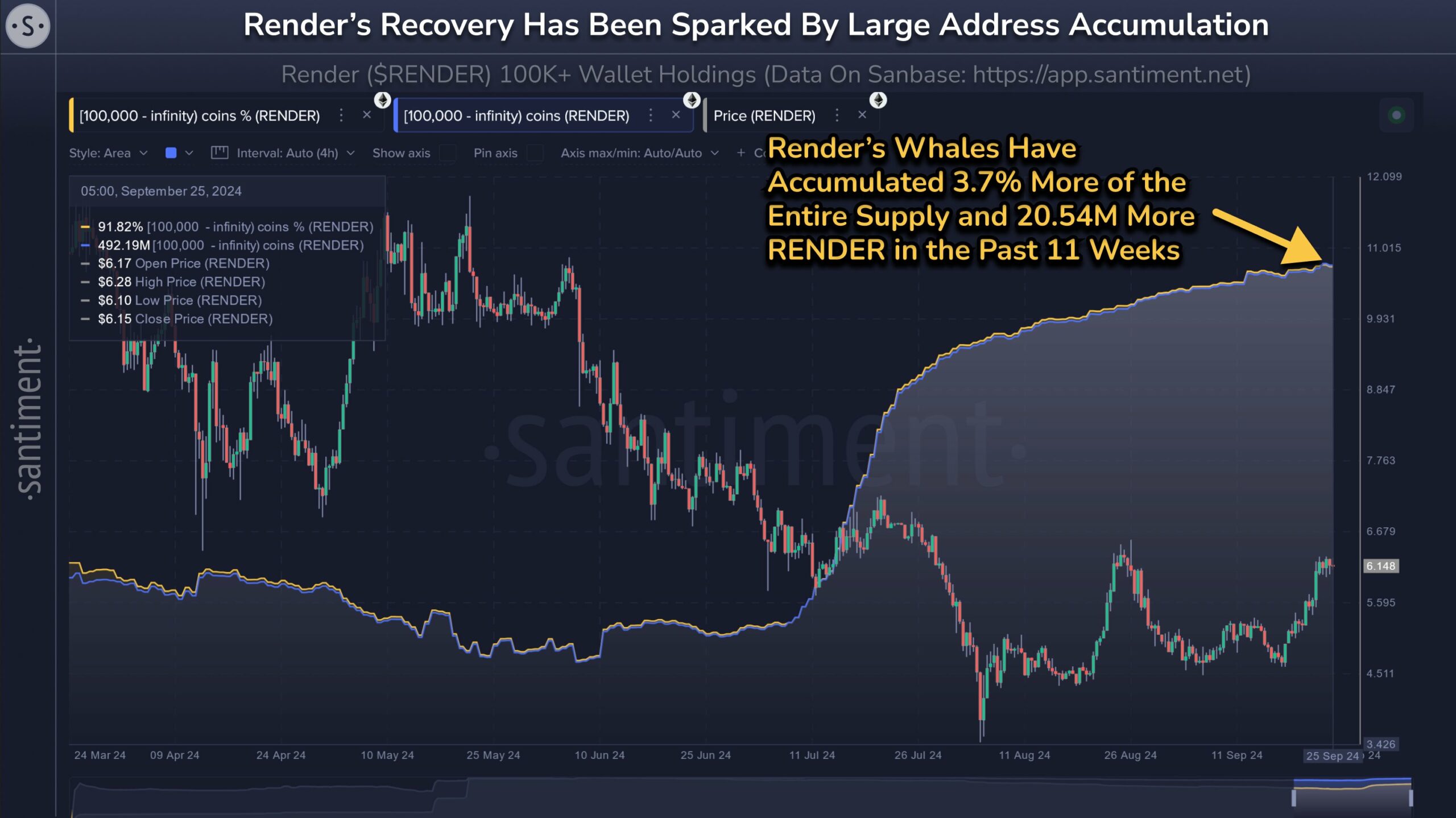

According to Santiment data, whales have increased their positions on RENDER during the recent recovery.

They grabbed 3.7% more in the past three months (20.54M tokens), bringing their dominance to 92% of the overall supply.

“Wallets with at least 100K RENDER, classified as sharks & whales, have accumulated 20.54M more coins (worth $126.3M) in 11 weeks and own 91.82% of the supply.”

Source: Santiment

Should you copy whales?

Such massive bids by large wallets always signal a high conviction in a potential price appreciation in the future, especially with bullish expectations in Q4.

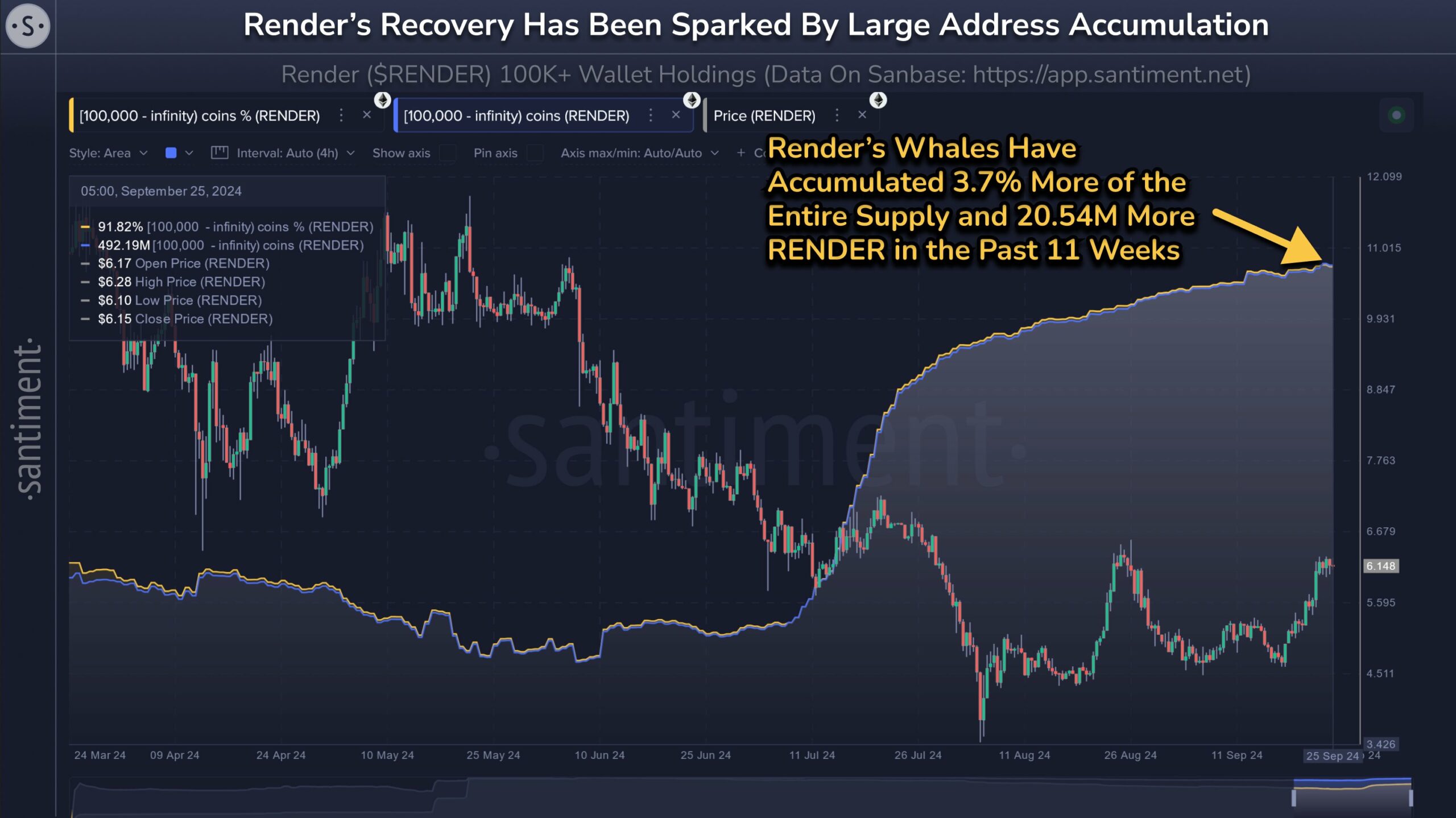

The token was up 26% in September amid an overall lift-off in the AI sector.

Source: RENDER/USDT, TradingView

Since the extended decline in August, RENDER has stayed below $6.3 (a Q3 low). On the daily charts, the altcoin has formed a bullish double-bottom pattern, with $6.2 as the neckline.

A breakout to the upside could rally RENDER nearly 30% and hit above $8 or the 200-day MA (Moving Average).

However, to extend the recovery, the bulls must clear the $6.2 mark. The bearish order block (OB), marked red, at $7.

If the token jumps above $7, the next bullish target would be $10.

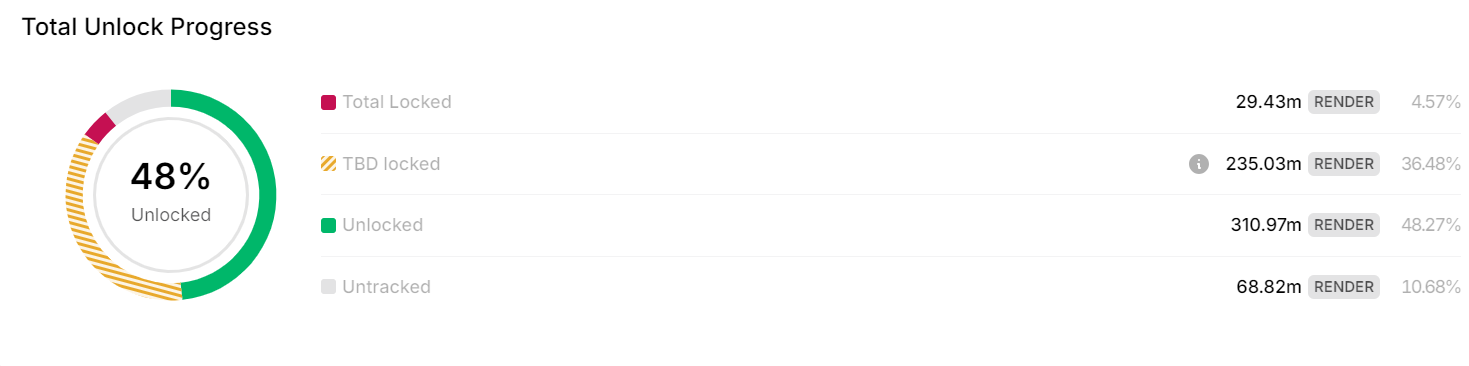

Source: Token Unlocks

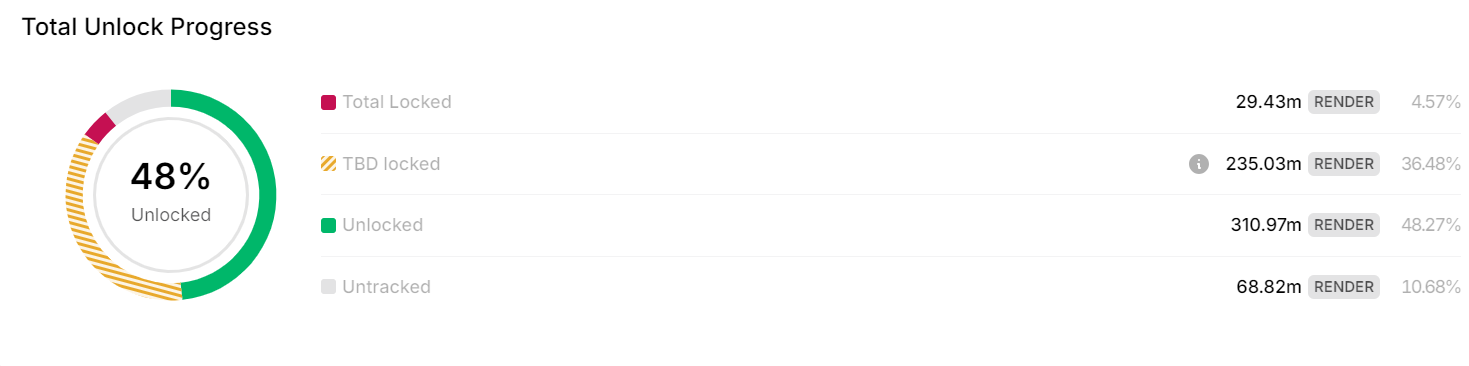

Despite RENDER’s attractive risk-reward (RR) ratio, there was still a significant supply overhang from token unlocks.

According to Token Unlocks data, only 60% of its total supply of 644 million tokens has been unlocked.

About 235 million tokens (To Be Determined Locked), meant things like treasury activities, were yet to be released, and there was no official timeline for their unlocks.

The huge supply overhang could affect prices if released to the market unexpectedly.

Ergo, whales’ dominance in RENDER meant they’d dictate prices. As such, speculators should take cues from whales’ actions to gauge market entry and profit-taking points.