- UNI and AAVE whales cashed out $12.7M in profits.

- Whale activity pointed to price fluctuations, but long-term prospects for both tokens remained strong.

In the past two days, four major crypto whales have collectively bagged $12.7 million in profits from Aave [AAVE] and Uniswap [UNI], sending ripples to the altcoins market.

This level of whale activity often signals price shifts, leaving many market participants wondering if these moves could hint at future price changes for these tokens?

Whales make significant moves

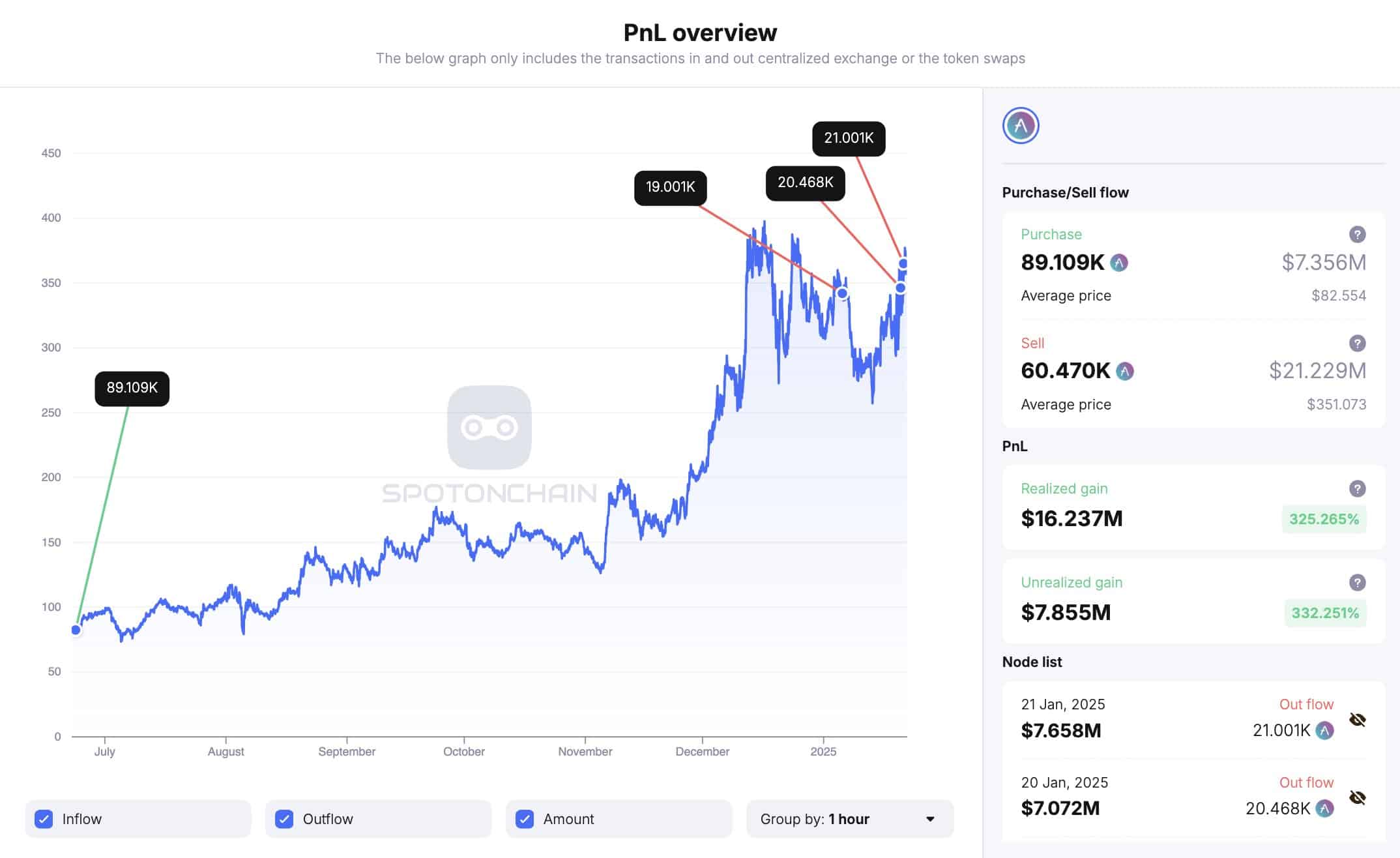

The largest transaction came from two whales, “0x991” and “0x97d” (likely one entity), who moved 41,469 AAVE—worth $14.7 million—over the last 40 hours.

These whales likely secured an impressive profit of $11.3 million, marking a 330% increase.

That not all, the two whales still hold a substantial amount of AAVE, valued at $10.2 million, with $7.86 million in unrealized gains as per the tweet.

This shows that even after cashing out, they have significant skin in the game.

Source: X

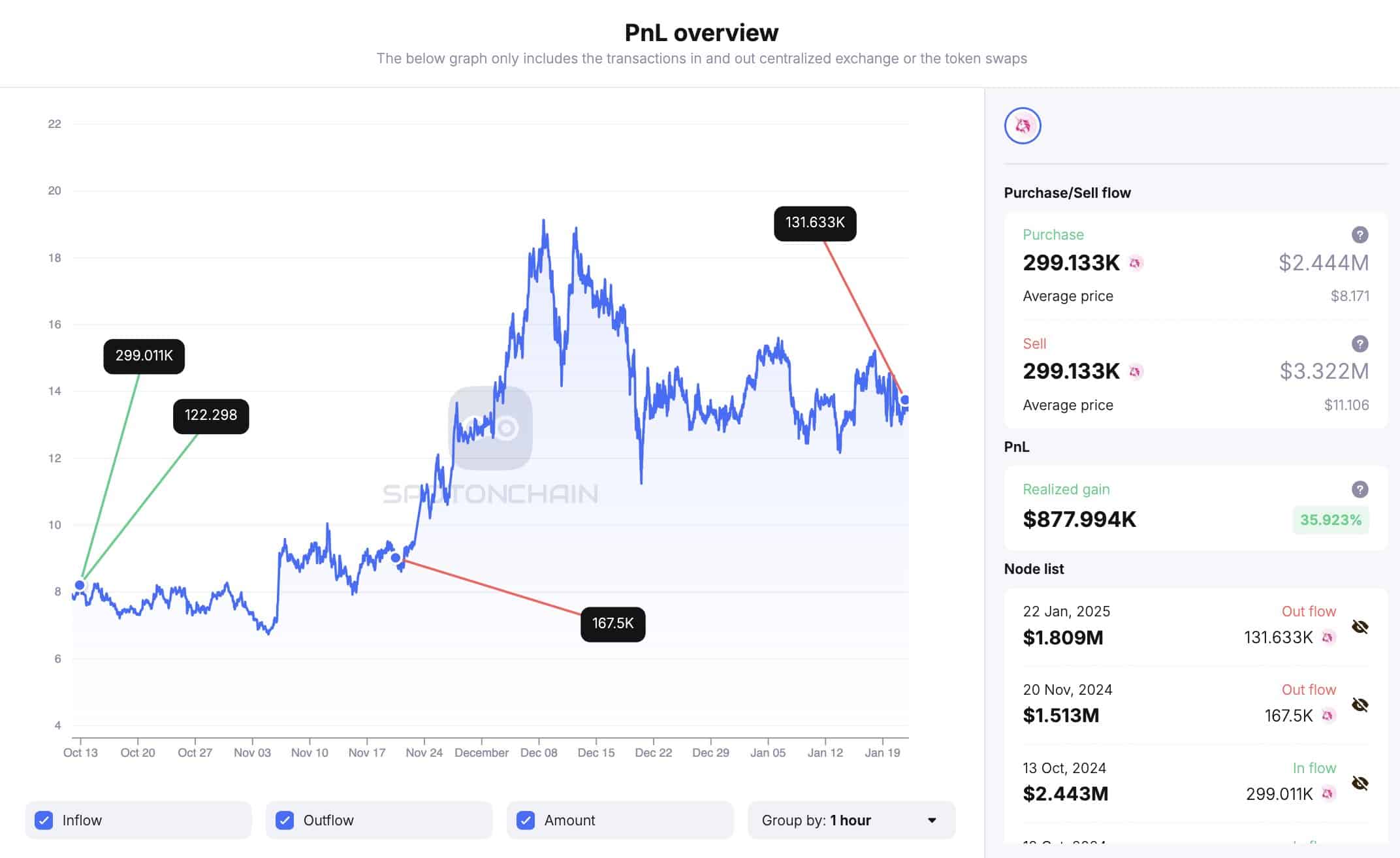

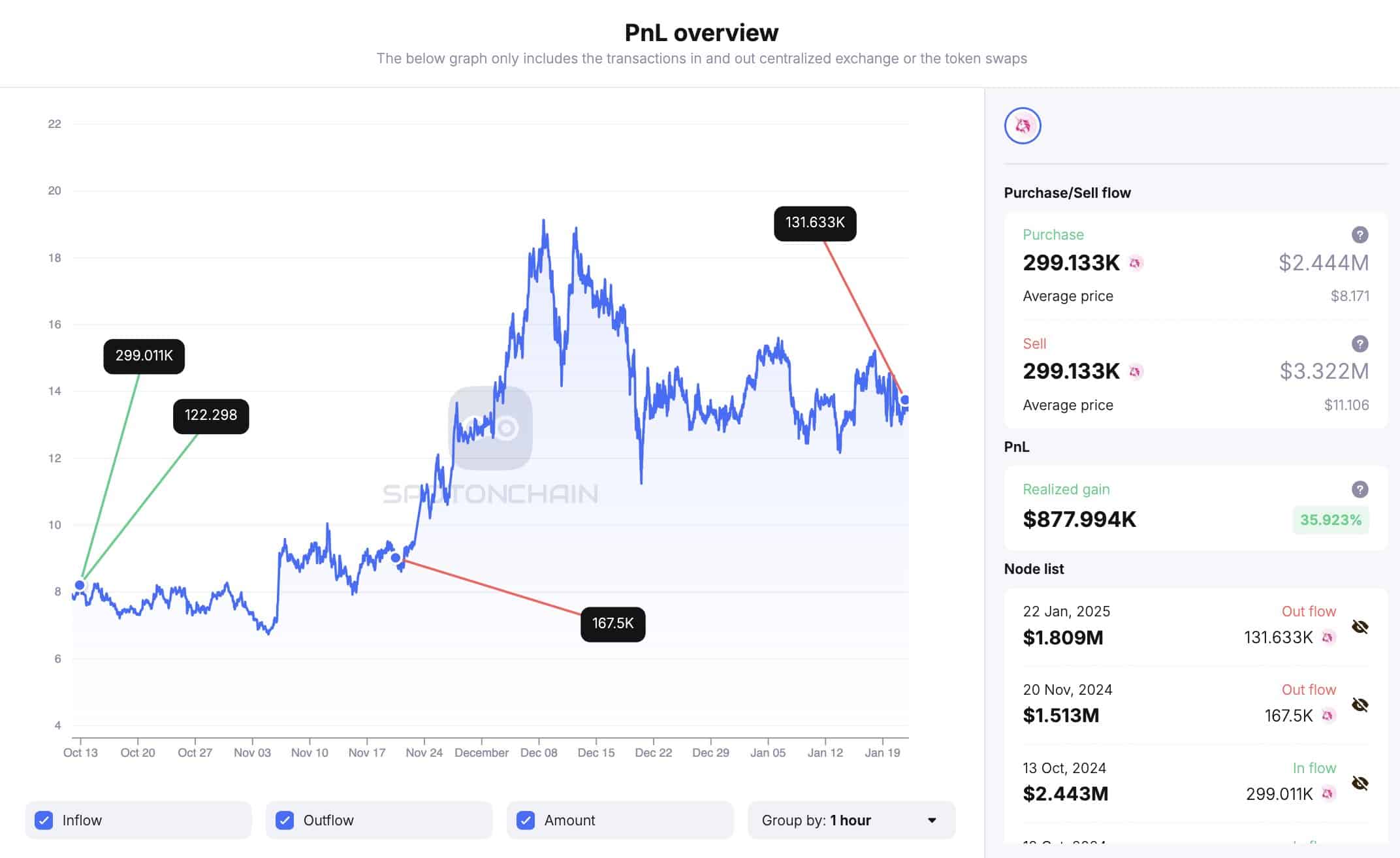

In another case, whale “0x1d1” deposited 131,633 UNI (worth $1.81 million) to Binance, bagging about $733K in profits-a 68% surge in just three months of holding.

Source: X

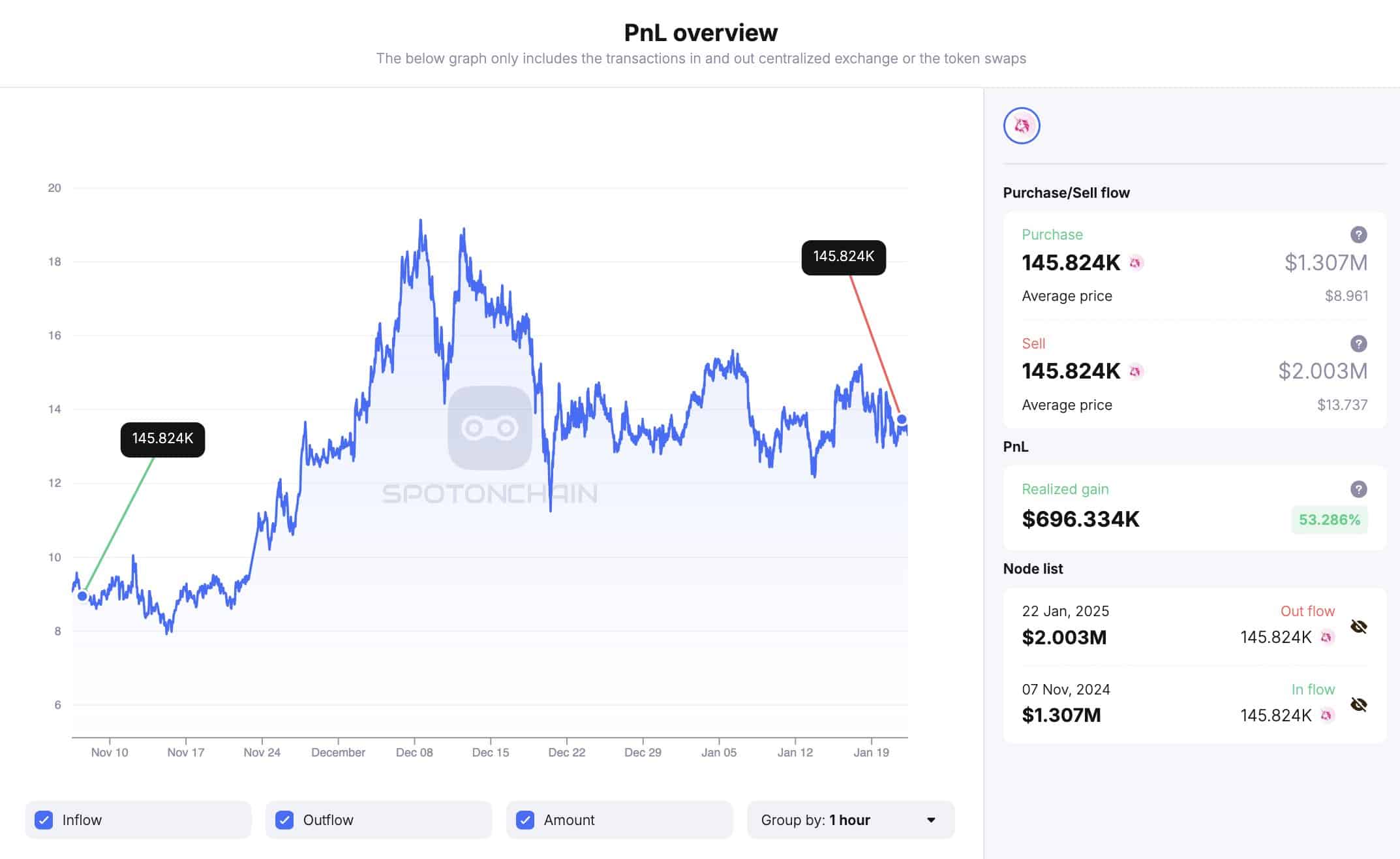

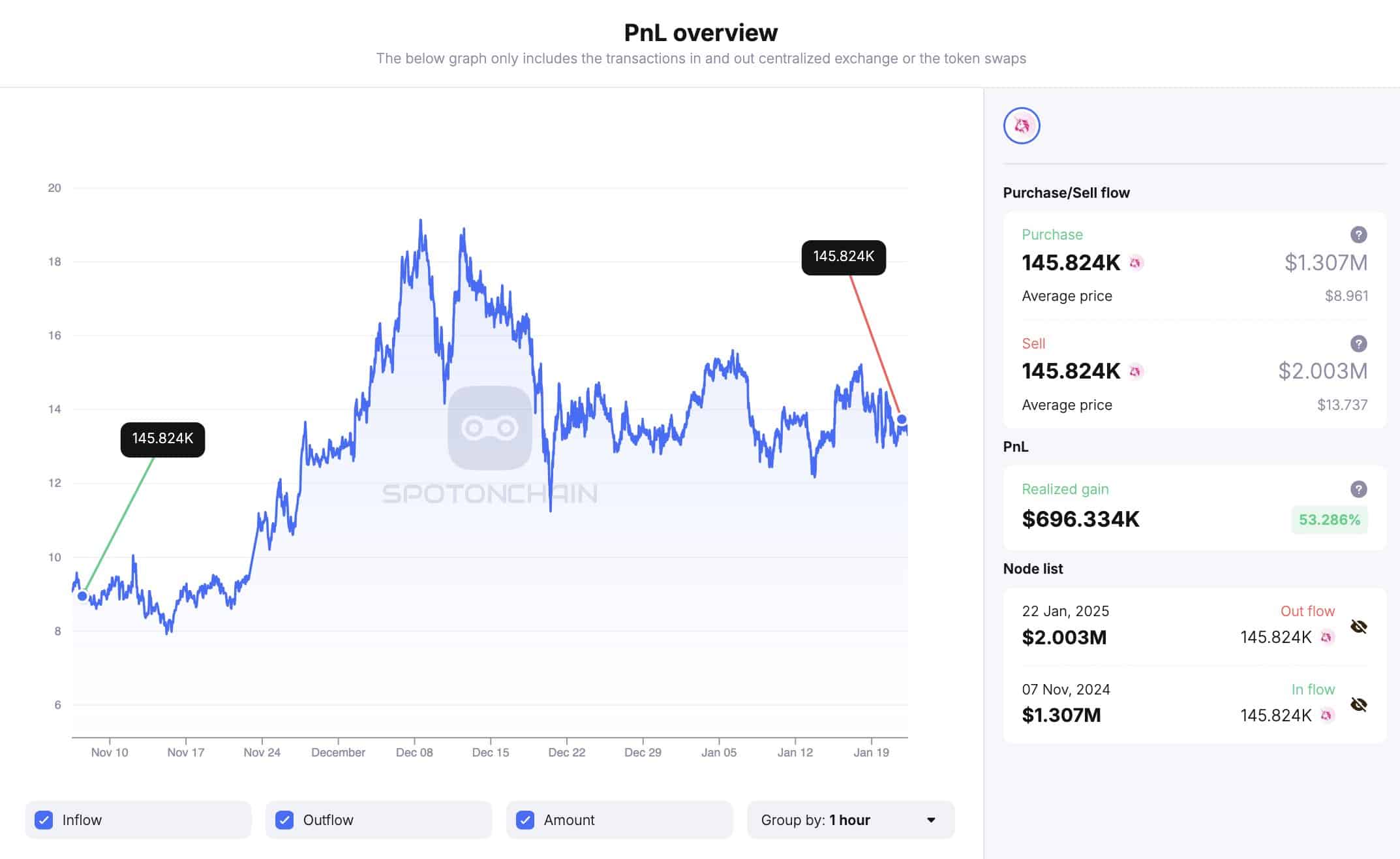

Meanwhile, wallet “0xcc0” moved 145,824 UNI, worth $2 million, to Binance, as a result gaining about $696K which is a 53% increase over 2.5 months.

Source: X

These whale movements are key to watch as they often affect the token prices. However, how does this relate to future price predictions?

What these whale moves mean for AAVE and UNI

Digging deeper into these recent whale transactions, we can expect some price fluctuations for both AAVE and UNI in the short term.

The massive exchange outflows could indicate a potential for price dips, as whales might be taking profits before a possible market correction.

However, the fact that they still hold substantial amounts of these tokens suggests they see long-term potential in AAVE and UNI.

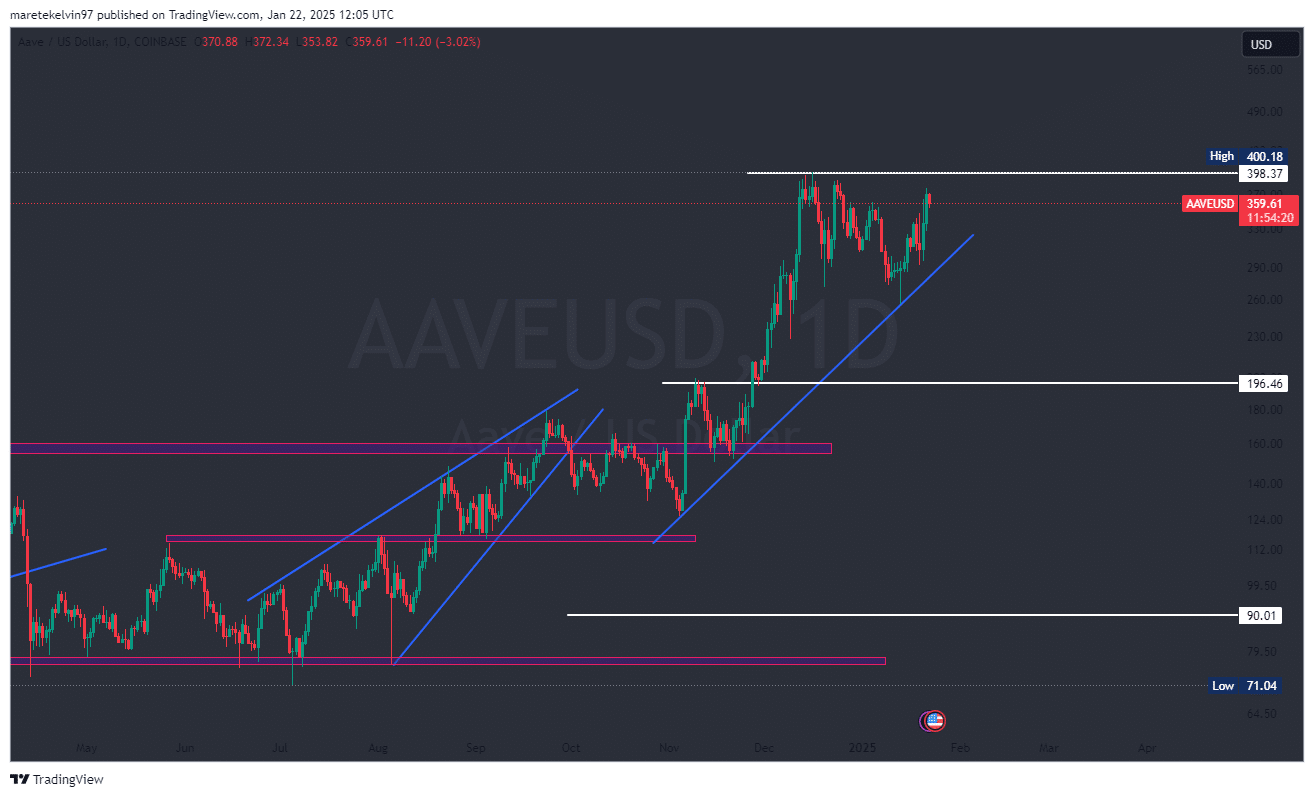

With the recent unrealized profits, it is reasonable to anticipate AAVE to consolidate on a short-term basis before rebounding for another upward move to test the $400 resistance zone.

Source: TradingView

Realistic or not, here’s AAVE’s market cap in UNI’s terms

Whale’s behavior often causes buying pressure whenever they maintain their positions over prolonged duration, and that can instigate a price rally for the altcoin.

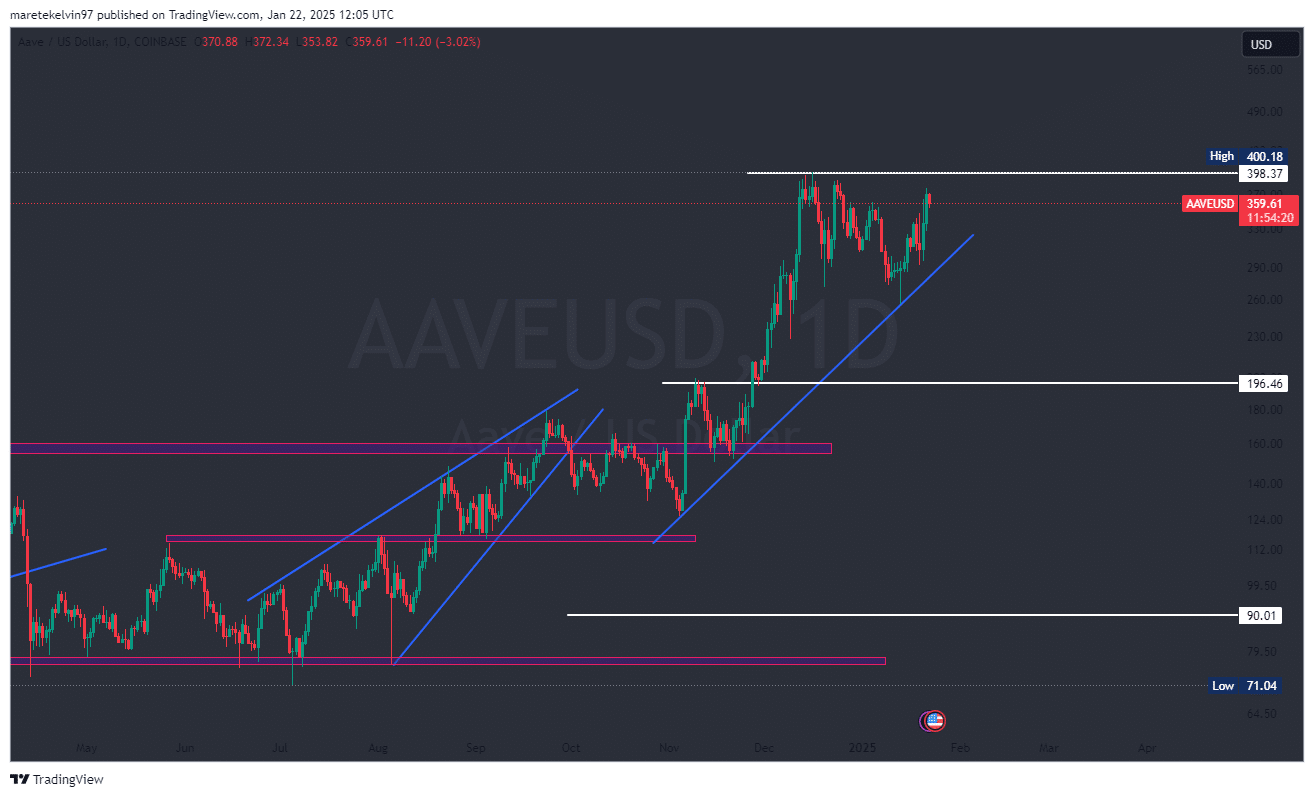

For UNI, the 68% surge in profit suggests that the altcoin is in a strong growth cycle, and even though some whales have cashed out, the token could continue its upward trajectory if more institutional interest pours in.

Source: TradingView