Major market vehicle segments all experienced seasonally adjusted prices that were down year over year in July.

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased in July compared to June, according to figures released Aug. 7 from the Manheim Used Vehicle Value Index (MUVVI), which rose to 201.6, a decline of 4.8% from a year ago.

The seasonal adjustment to the index amplified the impact on the month, resulting in values that rose 2.8% month over month. The non-adjusted price in July increased by 0.6% compared to June, moving the unadjusted average price down 5.9% year over year.

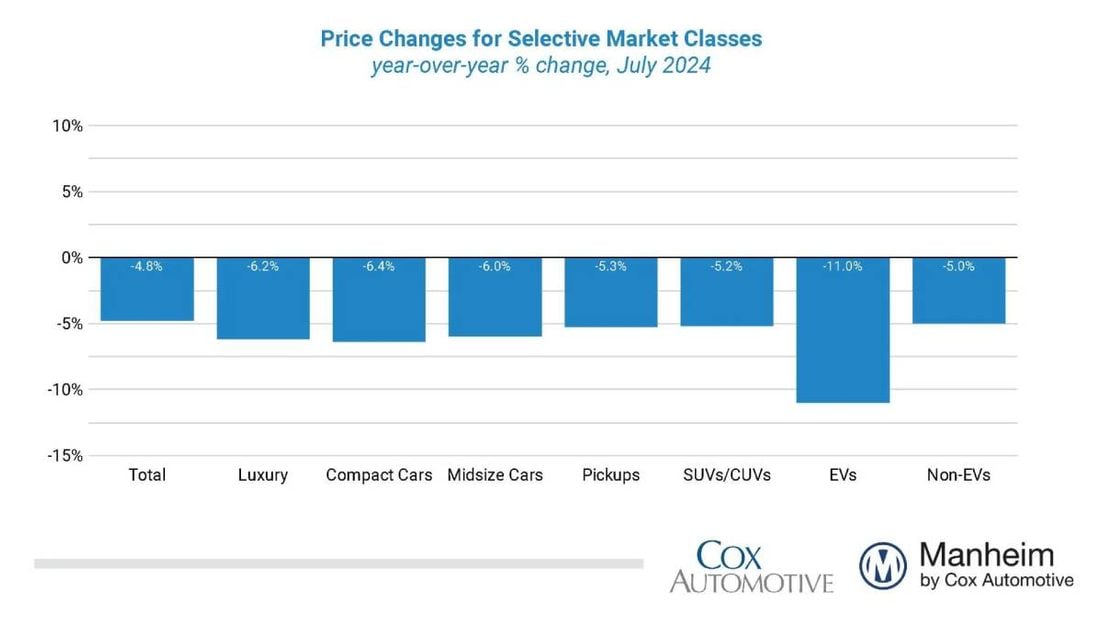

Meanwhile, the major market vehicle segments all experienced seasonally adjusted prices that were down year over year in July, although the pace of declines has slowed from previous periods.

“In late June, wholesale value declines slowed, and that trend continued throughout July as we saw values appreciate over the course of the month,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive, in a news release. “The sales conversion rate has been higher for each week in July, and that translated to higher prices overall at the wholesale level for the month. We are just beginning to see lower lease maturities for the key 3-year-old segment, and that impact will be felt over the rest of this year and into 2025 and 2026. As supply tightens for this key segment for the used vehicle market, we expect to see variances from historical average depreciation rates.”

In July, Manheim Market Report (MMR) values saw weekly increases in three of the last four weeks, clearly higher than what is normal for weekly value changes over the month. Over the last four weeks, the Three-Year-Old Index increased an aggregate of 1.1%, including a rise of 0.5% in the last week of the month. Those same four weeks delivered an average decrease of 0.6% between 2014 and 2019, illustrating that the appreciation trend for the month of July contrasted against long-term averages.

During July, daily MMR Retention, which is the average difference in price relative to the current MMR, averaged 98.6%, meaning market prices stayed below MMR values again this month yet moved closer than they were in June 2024. Against last month, valuation models moved up eight-tenths of a point on MMR retention. The average daily sales conversion rate rose to 60.1%, a rise of three and a half points over last month and higher than we normally see at this time of year. For comparison, the daily sales conversion rate averaged 51.9% in July over the last three years.

- Among major vehicle market segments, compared to July 2023:

- SUVs declined by 5.2%

- Pickups fell by 5.3%

- Midsize cars declined 6% against the prior year

- Luxury was down 6.2%

- Compact cars continued to show the worst performance, falling by 6.4%

Compared to the previous month, Cox saw some changes in performance, with midsize cars rising by 3.8% and compact cars increasing by 3.3%, both higher than the average rise of 2.8%. Showing rises less than the market, SUVs rose by 2.7% in the month, pickups were higher by 2.6%, and luxury overall increased by 1.6% against the prior month.

Looking at the market by powertrain, Cox notes clear differences in performance with additional data. Seasonally adjusted electric vehicle (EV) values for July 2024 were down 11%, while non-EVs were down 5% year over year. Looking at the change against last month, seasonally adjusted EV values were flat with the market overall, both rising by 2.8% from June 2024, while non-EVs increased by 3.3% over the same period.

Retail Used-vehicle Sales Increased in July

Assessing retail vehicle sales based on observed changes in units tracked by vAuto, Cox estimates that retail used-vehicle sales in July were up 5% compared to June but lower year over year by 2%. The average retail listing price for a used vehicle decreased 0.5% over the last four weeks.

Using estimates of retail used days’ supply based on vAuto data, an initial assessment indicates July ended at 53 days’ supply, up one day from 52 days at the end of June and up four days from July 2023 at 49 days.

New-vehicle sales in July were down 2% from last year, and volume was down 3% from June. The July sales pace, or seasonally adjusted annual rate (SAAR), came in at 15.8 million, down 0.1 million from last year’s pace and up from June’s 15.2 million level.

Combined sales into large rental, commercial, and government fleets decreased 14% year over year in July. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining new retail sales were estimated to be up 1.6% from last year, leading to an estimated retail SAAR of 13.1 million, down 0.1 million from last year’s pace, but up from June’s 12.7 million level. Fleet share was estimated to be 13.9%, down from last year’s 17.0% share.

Rental Risk Prices and Mileage Changes Were Mixed in July

The average price for rental risk units sold at auction in July declined 0.6% year over year. Rental risk prices increased by 1.8% compared to June. Average mileage for rental risk units in July (at 54,700 miles) fell against the prior year, down 3.0% for the month against last year’s level. For the month of July, rental unit average mileage increased 10.3% from June 2024.

Measures of Consumer Confidence Were Mixed in July

- The Conference Board Consumer Confidence Index increased 2.6% in July, as views of the future improved, but views of the present declined. Consumer confidence was down 12% year over year for its worst year-over-year performance since July 2022. Plans to purchase a vehicle in the next six months declined compared to June and were lower than in July last year and represented the lowest share of people planning to buy in nine months.

- According to the sentiment index from the University of Michigan, consumer sentiment declined 2.6% in July compared to June and was down 7.1% year over year. The median consumer expectation for inflation in a year declined to 2.9%, which was the lowest level in four months and matches the lowest level since 2020. The expectation for inflation in five years was steady at 3%. The consumer’s view of buying conditions for vehicles declined to the lowest level since December 2022 as the view of interest rates and prices remains very negative.

- The daily index of consumer sentiment from Morning Consult saw its best month of improvement since February in July as it increased 1.9%, leaving the index up 2.1% year over year.

- Gas prices declined 0.2% in July as gas prices declined over the last week of the month. The national average price for unleaded gas from AAA was down 0.2% from the end of June to $3.48 per gallon as of July 31, which was down 8% year over year.