- Bitcoin dominance declined in the last few days.

- Ethereum’s technical indicators looked bearish, but BNB was bullish.

The market was somewhat in a consolidation phase as most of the cryptos didn’t show much volatility. However, this just might be the beginning of an altcoin season.

Latest analysis revealed that the altcoin market capitalization was about to breakout above a bull pattern, which could result in a massive rally.

Altcoins prepare for a rally

World Of Charts, a popular crypto analyst, recently posted a tweet revealing an interesting development. As per the tweet, a broadening falling wedge pattern appeared on the altcoin market cap chart. This is a bullish pattern, hinting at a price rise for alts in the coming days.

The better news was that at the time of writing, the alt market cap just broke above the upper limit of the pattern. This clearly indicated that investors could expect a massive altcoin rally in the coming days.

If the tweet is to be believed, then the altcoins market cap could surge by more than 300% in the coming days.

Source: X

AMBCrypto then checked other datasets to find whether they also hint at a similar outcome. As per our analysis of Coinstats’ data, after a sharp rise, Bitcoin [BTC] dominance declined over the last few days.

This also indicated a rise in altcoins’ prices. However, the Altcoin season index had a different reading.

The metric revealed that the market was still close to a Bitcoin season, as the metric’s value was 31. For reference, a value closer to or above 75 indicates an altcoin season.

Source: Blockchaincenter

How are ETH and BNB doing?

To better understand which way altcoins were heading, AMBCrypto checked the states of two of the major altcoins, Ethereum [ETH] and BNB.

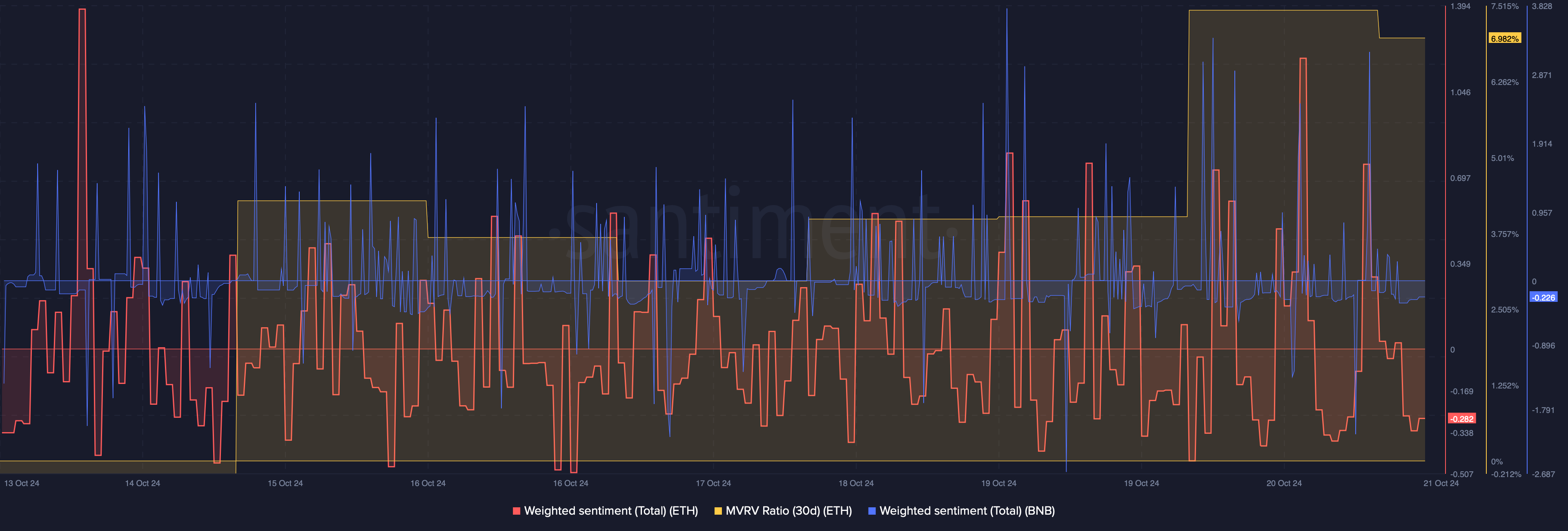

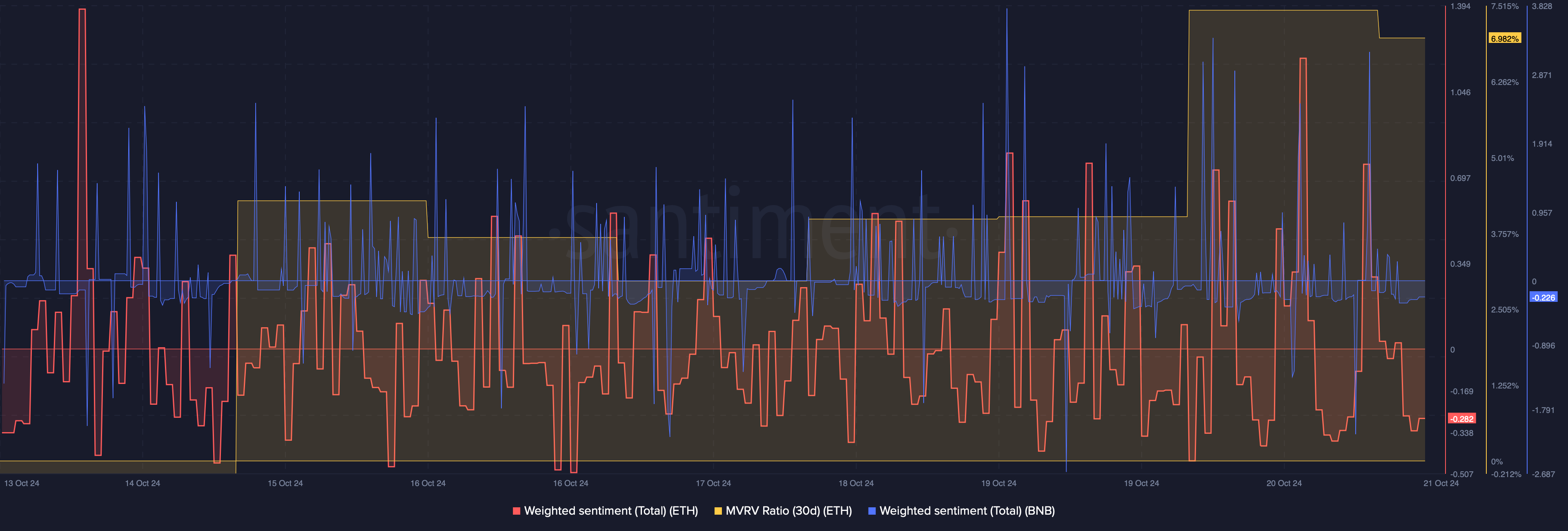

As per our analysis of Santiment’s data, both ETH and BNB’s weighted sentiment remained in the positive range for the majority of the time last week.

This meant that bullish sentiment around both tokens was high in the market, hinting at a price rise. Additionally, ETH’s MVRV ratio also increased sharply, which can be inferred as a bullish signal.

Source: Santiment

We then assessed both tokens daily charts to better understand what to expect from these altcoins. We found that Ethereum was approaching resistance.

However, the Relative Strength Index (RSI) registered a downtick. This suggested that ETH might get rejected near its resistance.

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024-25

However, BNB was looking optimistic. This was the case, as it managed to break above a resistance. Additionally, its RSI also sustained the uptrend, indicating a continued price increase.

Source: TradingView