- FLOKI is facing strong resistance at $0.00017480, despite rising volume and bullish momentum

- Slight hike in daily active addresses and a potential short squeeze could fuel a breakout

Floki Inu [FLOKI] has been drawing significant attention due to its recent bullish run, capturing interest from both retail and institutional investors as its price steadily climbed. At press time, the altcoin was trading at $0.0001504, up by 6.62% in the last 24 hours.

Additionally, its 24-hour volume also surged by 19.81% – A sign of increased activity among traders.

However, despite this positive momentum, FLOKI faces a crucial challenge at the $0.00017480 resistance level. Can it finally push through this level and continue rising, or will it retreat as it has in its previous attempts?

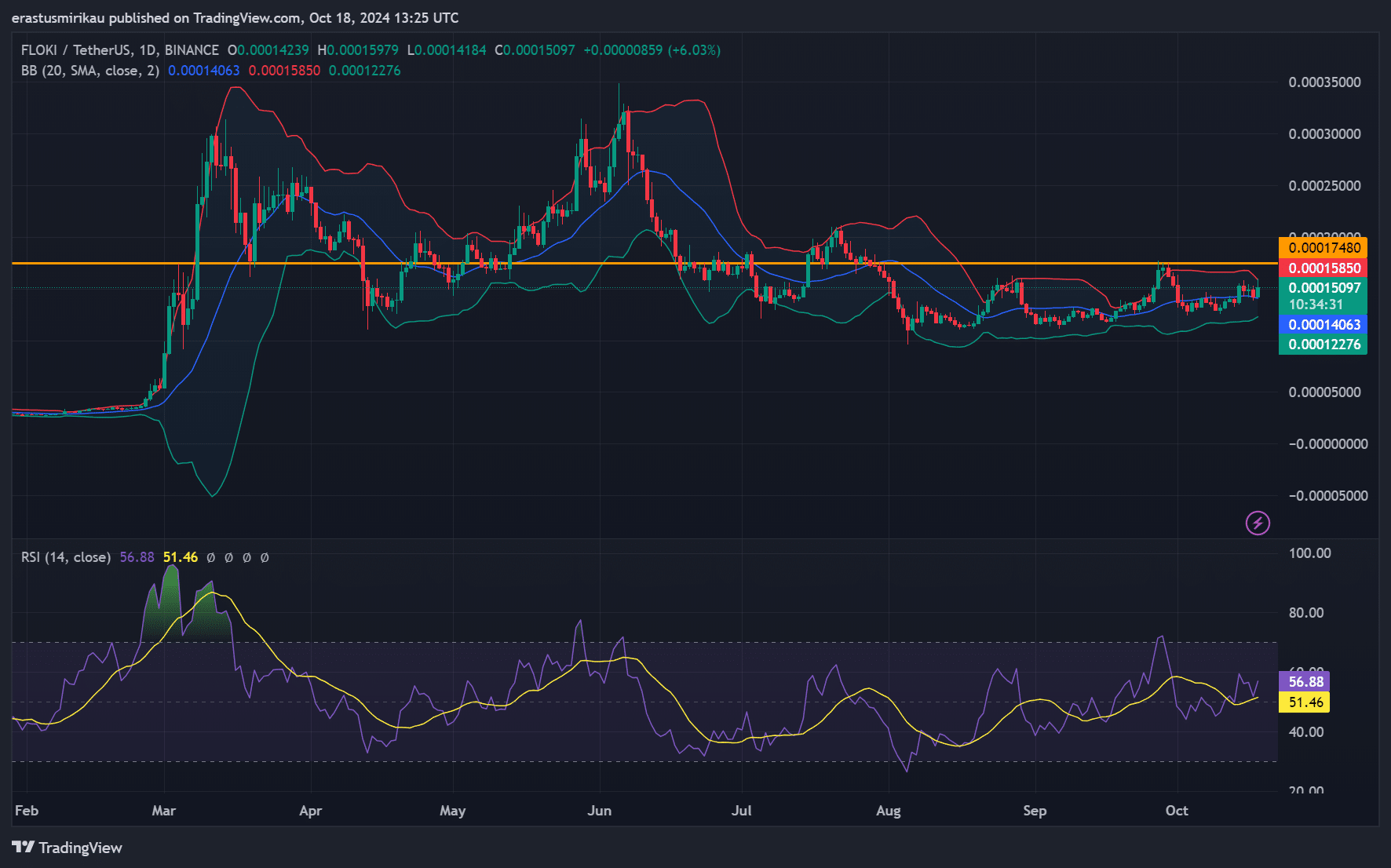

FLOKI chart overview – Pressure mounts at the resistance

The daily chart showed the memecoin testing the $0.00017480 resistance level, a key barrier it has failed to overcome in previous rallies. The Bollinger Bands have been tightening around the price, indicating reduced volatility, while the Relative Strength Index (RSI) sat at 56.88.

Therefore, FLOKI still has some room to move before reaching overbought conditions.

However, to break through this resistance level, the memecoin will need to see a strong hike in buying pressure. Consequently, the prevailing technical indicators underlined a potential breakout, but only if the volume continues to rise too.

Source: TradingView

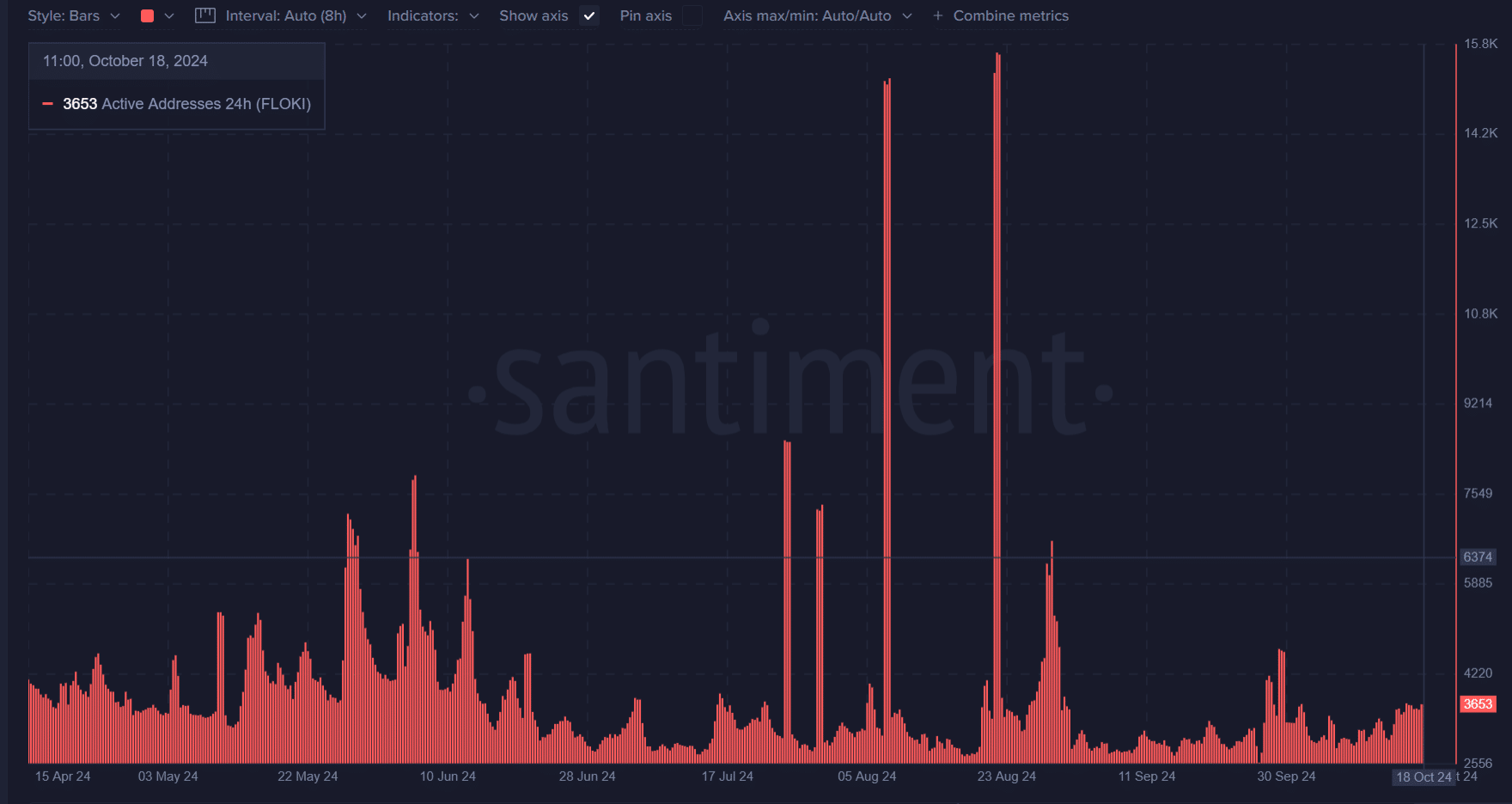

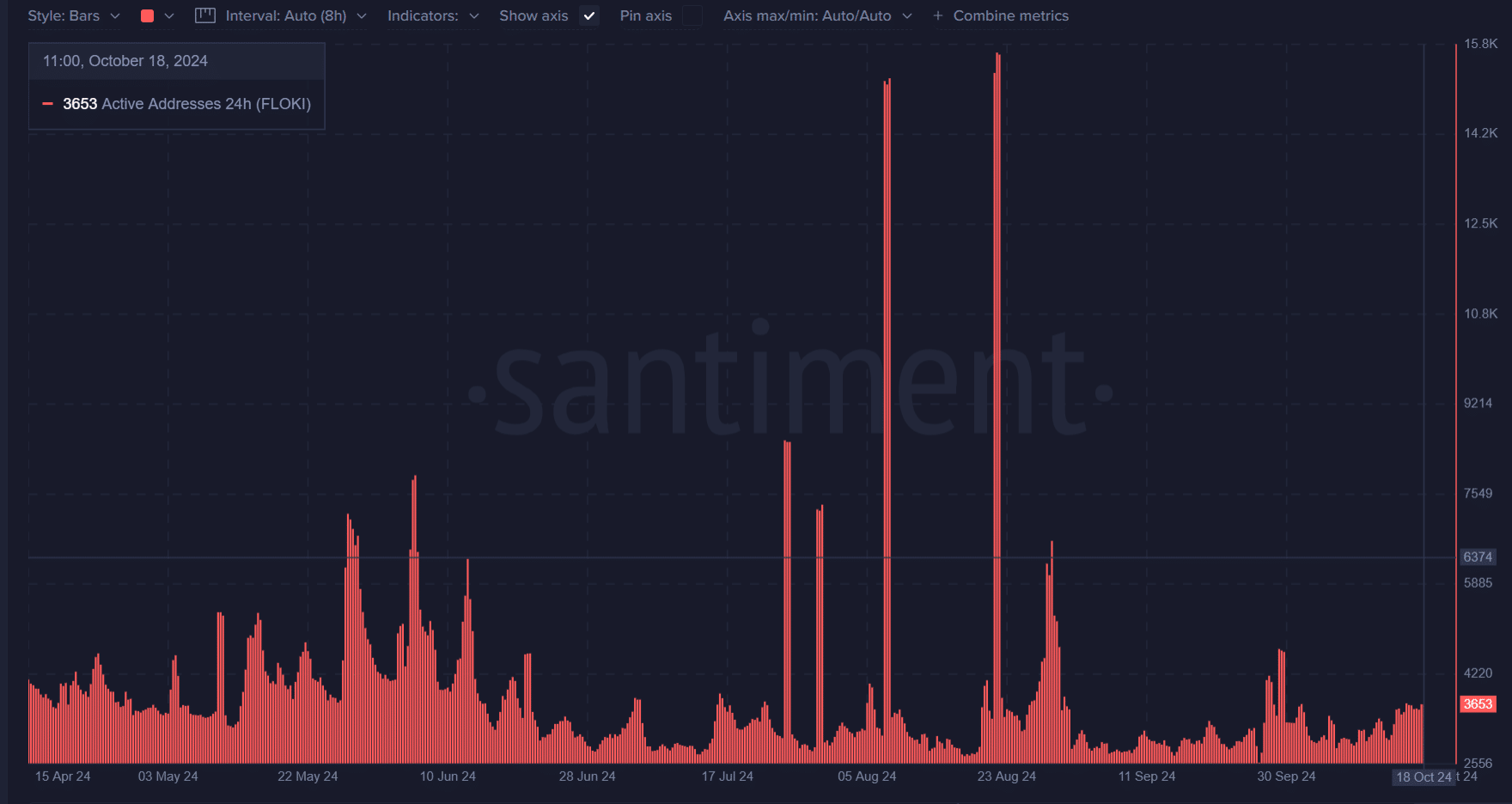

FLOKI daily active addresses – Is interest returning?

Interestingly, FLOKI’s daily active addresses have risen slightly to 3,653 from the previous day’s figures of 3,560. This highlighted a marginal increase in user engagement. However, this number still pales in comparison to the surges seen earlier in the year, when active addresses spiked to over 10,000.

Therefore, while the uptick in activity is a positive sign, it’s clear that FLOKI needs stronger retail participation to sustain any significant price movement.

Additionally, the ongoing engagement might not be enough to break the resistance level.

Source: Santiment

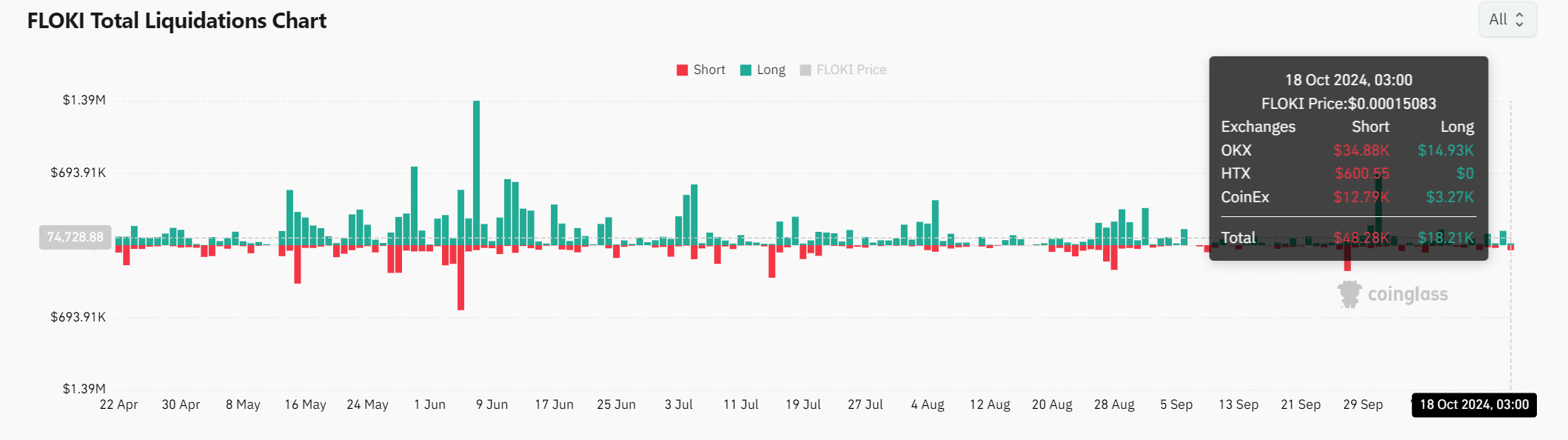

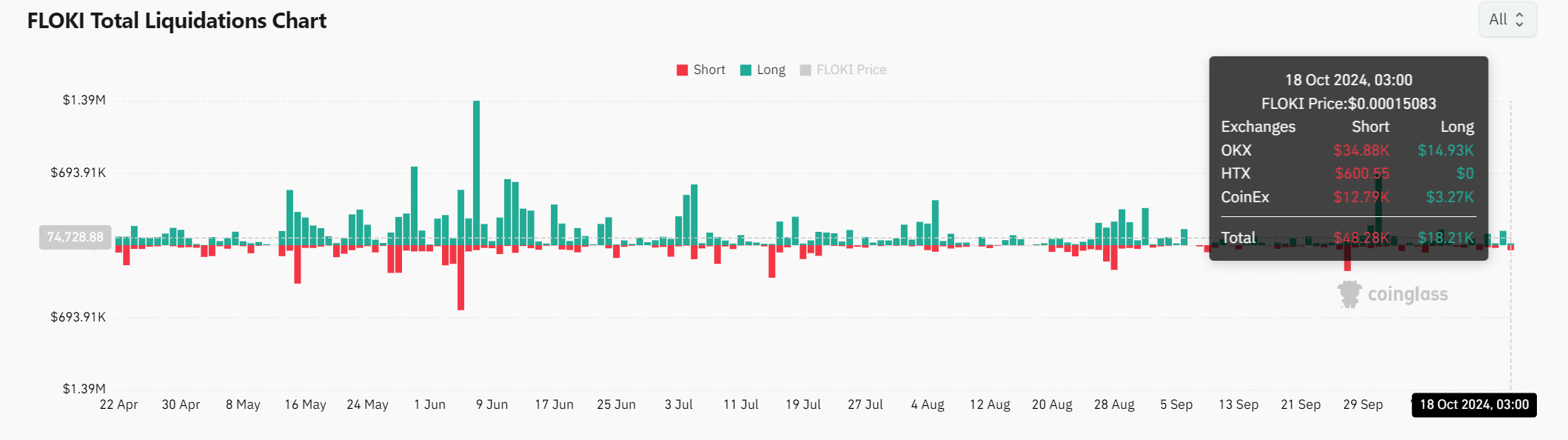

FLOKI liquidations – Short squeeze on the horizon?

Over the past 24 hours, the memecoin has seen $48.28k in short liquidations, compared to $18.21k in long liquidations. Consequently, this is a sign that bearish traders may soon be forced out of their positions, which could add significant upside pressure to FLOKI’s price.

Additionally, if FLOKI manages to break the resistance, a potential short squeeze could further fuel its rally.

Source: Coinglass

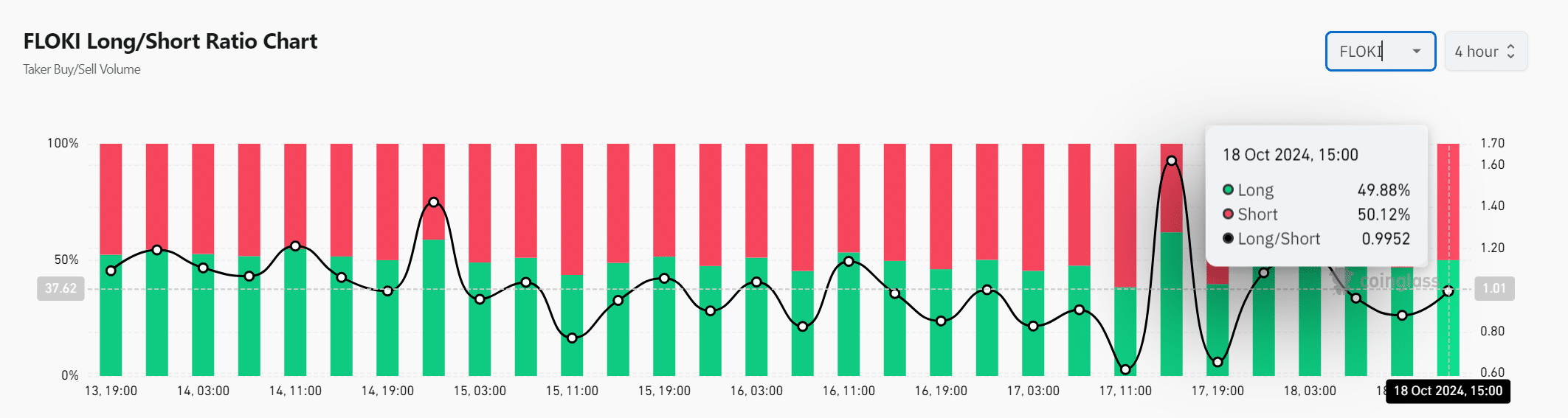

Long/short ratio – Are the bears in control?

The long/short ratio, at press time, stood at 0.9952, indicating a near-equal battle between bulls and bears. However, the shorts seemed to be slightly ahead at 50.12%, reflecting a degree of caution among traders.

Consequently, if the memecoin fails to break resistance, bears could quickly regain control. On the other hand, a successful breakout could force bears to cover their positions.

Source: Coinglass

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Ultimately, FLOKI’s future depends on whether it can break through the $0.00017480 resistance.

While rising volumes and increasing short liquidations offer optimism, the lack of significant daily engagement raises some concerns. If traders can sustain the buying pressure, FLOKI might push higher.