- Worldcoin has surged ahead of major altcoins in the last 24 hours.

- AMBCrypto has uncovered the key drivers behind this impressive rally.

Worldcoin [WLD] has broken free from nearly two months of bearish consolidation.

It retested the key $2 rejection level with an impressive 11% surge and a remarkable 100% spike in volume over the last 24 hours, outpacing many major altcoins.

Bulls now face a crucial test to maintain this range. Unlike previous attempts hindered by Bitcoin’s downward swings, current optimism is palpable, setting the stage for a potential $3 breakout.

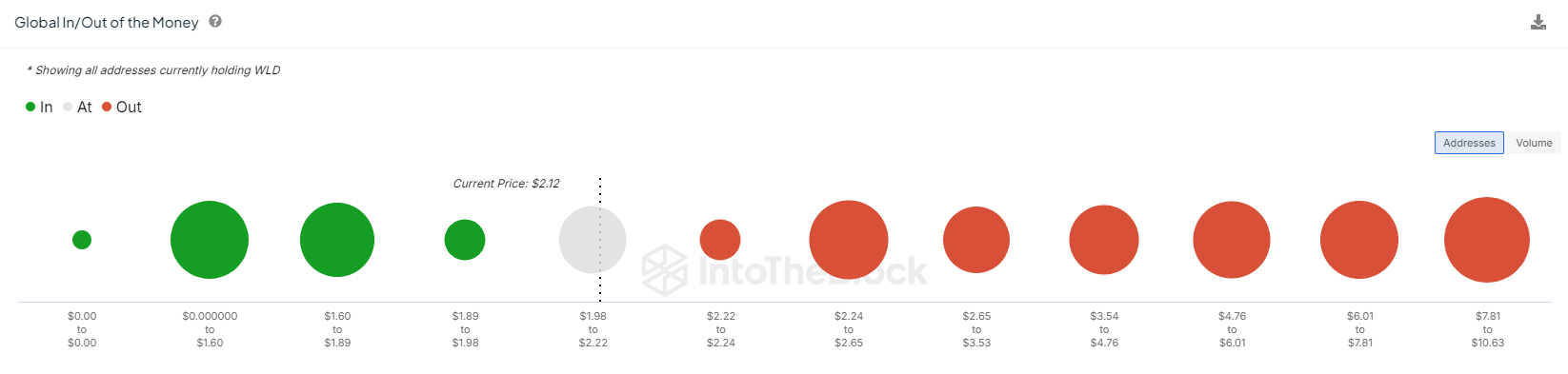

Most Worldcoin holders are in a loss position

Worldcoin, aimed at building the largest financial network, surged to an ATH of $11.9 within a year of its launch, typically coinciding with Bitcoin’s ATH of $73K in March.

Notably, WLD exhibited broader user engagement, with an RSI peaking at 94 and a CMF at 40.

AMBCrypto’s analysis indicates that this surge was driven by aggressive buy-outs, suggesting many holders are now facing net losses.

Significantly, around 4.28K addresses, holding 1.54 million Worldcoin, purchased at an average price of $8 – substantially higher than the current price of $2.14.

Source : IntoTheBlock

While this situation appears bearish, as breakeven could lead to realized losses, these holders are likely to retain their positions.

On the flip side, a retracement to $1.93 could be more concerning, as it might attract liquidity of around 4 million WLDs.

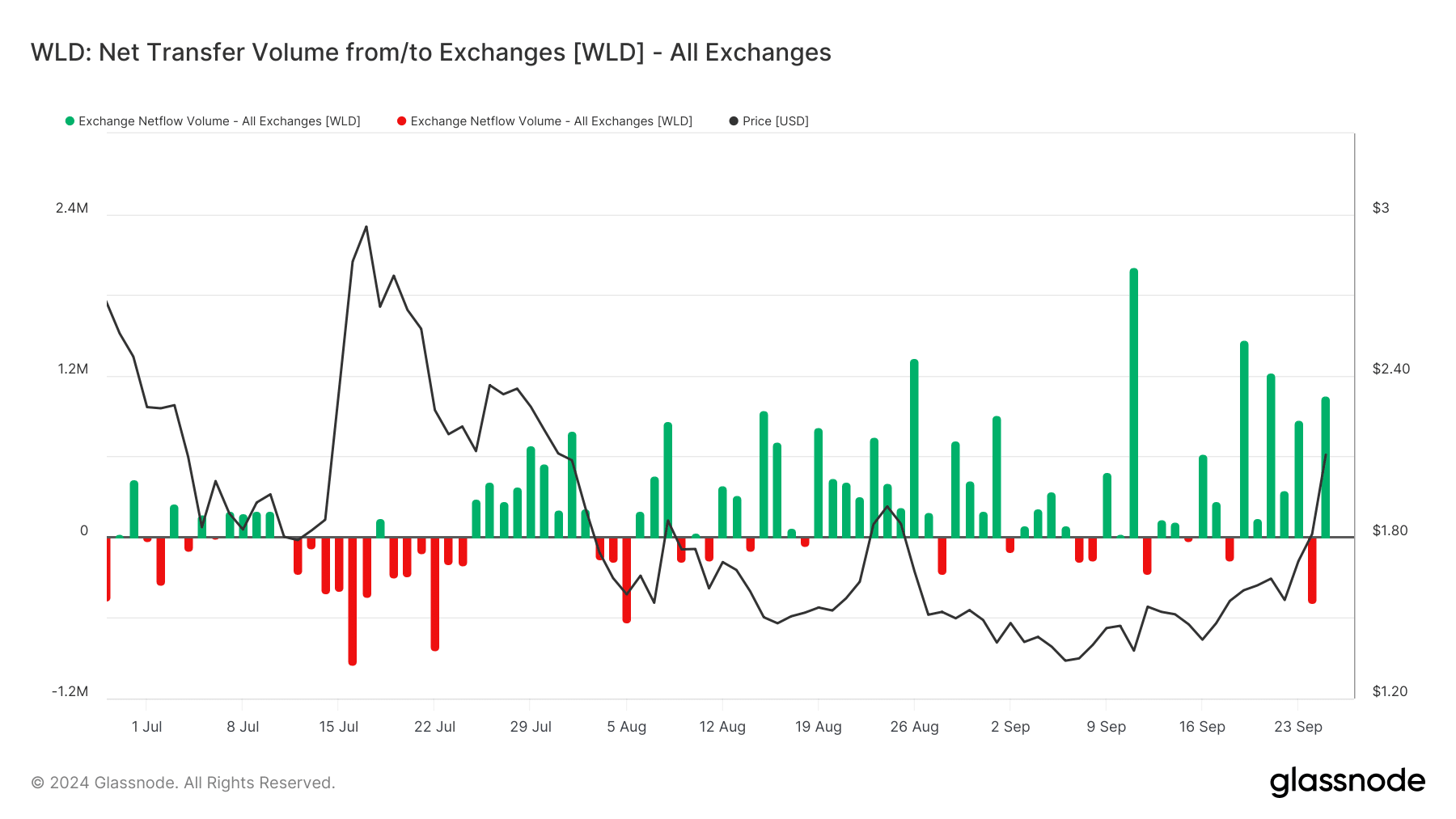

Traders cashing in on every surge

Interestingly, every time Worldcoin approaches a critical level, it often coincides with a surge in net inflows the following day.

For instance, in mid-July, when bulls attempted to stave off a pullback, WLD surged by 11% in a single session, but a subsequent spike in deposits acted as resistance the next day.

Source : Glassnode

Put simply, even a minor surge in Worldcoin’s value triggers a spike in traders cashing in before the rally waves.

Additionally, throughout August and September, there was a consistent flow of WLD into exchanges, peaking at $2 million.

Yet, Worldcoin surged by a remarkable 30% in the past week, suggesting third-party involvement that absorbed the selling pressure.

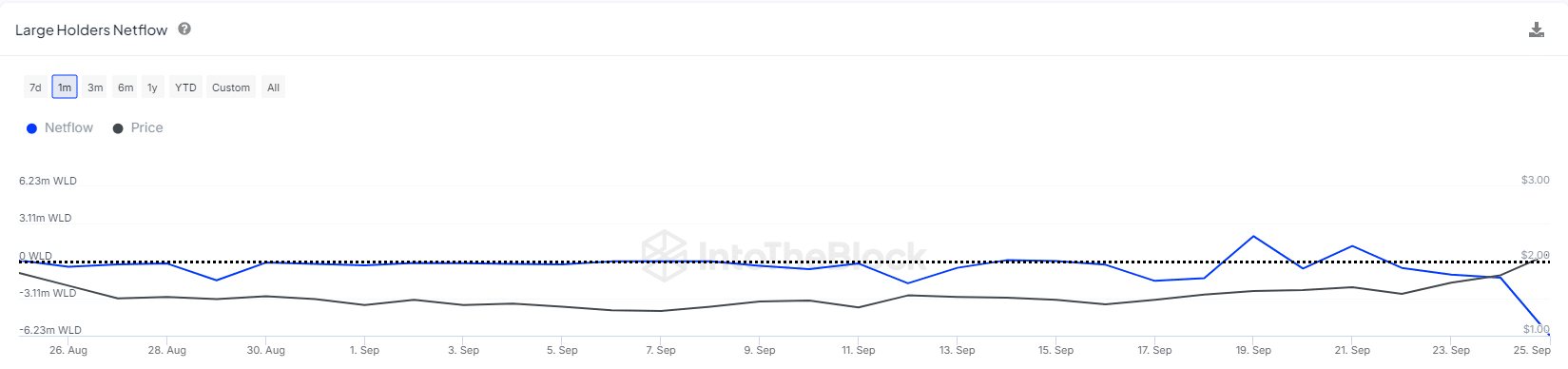

WLD will breakout if THIS stays in play

Worldcoin whales dominate the large holder segment, holding an impressive 8.38 billion WLD, accounting for 83.80% of the total supply.

In the past five days, these whales have amassed over 9 million WLD from exchanges, including a recent acquisition of 6.23 million, as shown by the sharp plunge below.

Source : IntoTheBlock

Read Worldcoin’s [WLD] Price Prediction 2024-25

According to AMBCrypto, these aggressive withdrawals have effectively absorbed selling pressure. Notably, the latest accumulation coincided with Worldcoin breakthrough of the $2 barrier.

Put simply, the whales are strategically positioning for future gains, aiding WLD in breaking critical resistance. If this trend holds, Worldcoin could soon experience a breakout to $3.