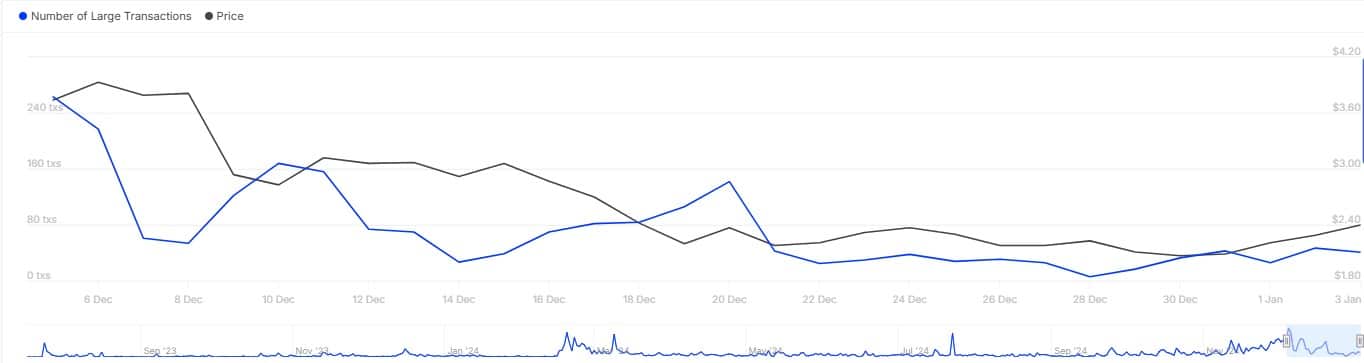

- Worldcoin’s large transactions dipped by 74% over the last 24 hours.

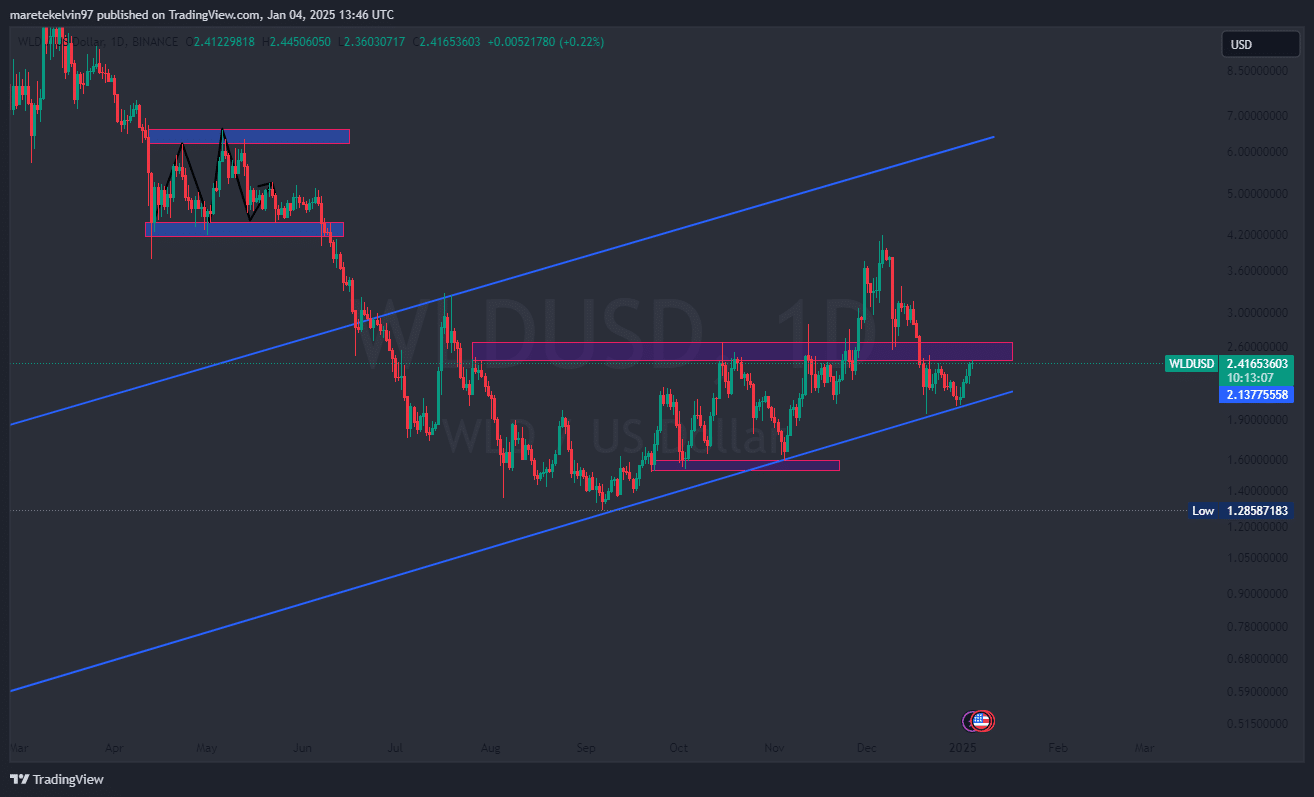

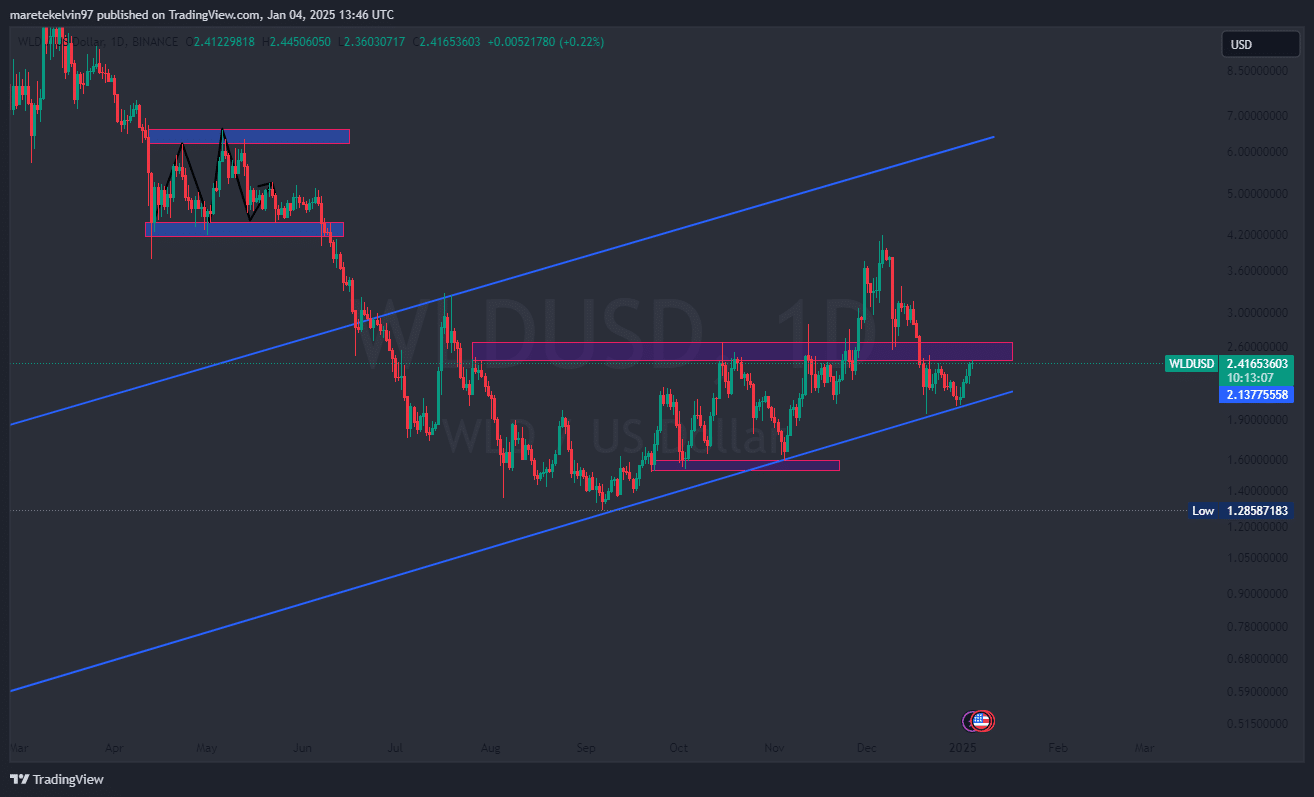

- A test of the ascending trendline support level might be on the horizon.

The Worldcoin [WLD] ecosystem is already in an uproar after the recent German directive to delete iris scans.

An attempt to handle this situation with the most cautiousness in terms of privacy has further complicated Worldcoin’s adoption efforts.

The ripple effects are already beginning to appear in the market, more so in whale activity-a key driver of WLD’s price momentum.

Data from IntoTheBlock showed a significant 74% drop in WLD’S large transactions over the past 24 hours. This sharp decline indicated a potential pause or reevaluation by major investors.

Since the altcoin’s whale activity often correlates with market sentiment, the current trend could depend heavily on WLD’s short-term trajectory.

Source: IntoTheBlock

What whale activity drop means for WLD

Whale transactions are vital in driving liquidity and price stability. With fewer large transactions, WLD’s price dynamics could be much more volatile.

The reduced interest from big players may signal caution, especially while regulatory concerns cast a shadow over the project’s adoption goals.

A decline in whale participation usually suggests weakening confidence. For WLD, this may point to limited upward momentum in the near term.

With smaller investors taking the biggest hits of market movements, a short-term price correction is more likely.

Testing the ascending trendline

Worldcoin’s daily price chart suggested a potential test of the ascending trendline support level. This support level had previously acted as a critical price floor, helping the altcoin rebound during periods of sell pressure.

If the trendline fails to hold, WLD could face further downside, intensifying its already bearish sentiment.

However, a successful bounce could reassure investors and provide an opportunity for a short-term rally.

Source: TradingView

Is a recovery possible?

While the recent slump in whale activity does raise certain red flags, the greater WLD adoption story could continue to resonate with long-term investors.

The project’s vision, despite setbacks, is still capable of regaining momentum once all regulatory challenges have been resolved.

Read Worldcoin’s [WLD] Price Prediction 2025–2026

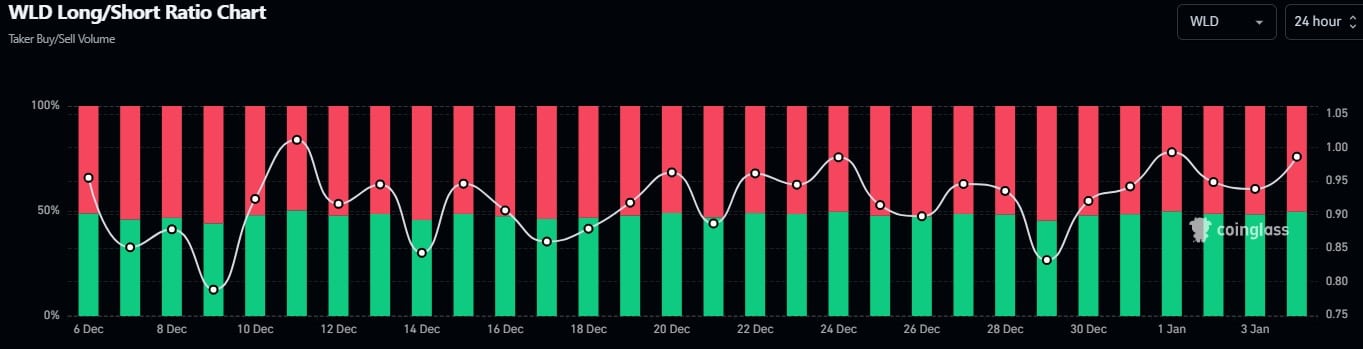

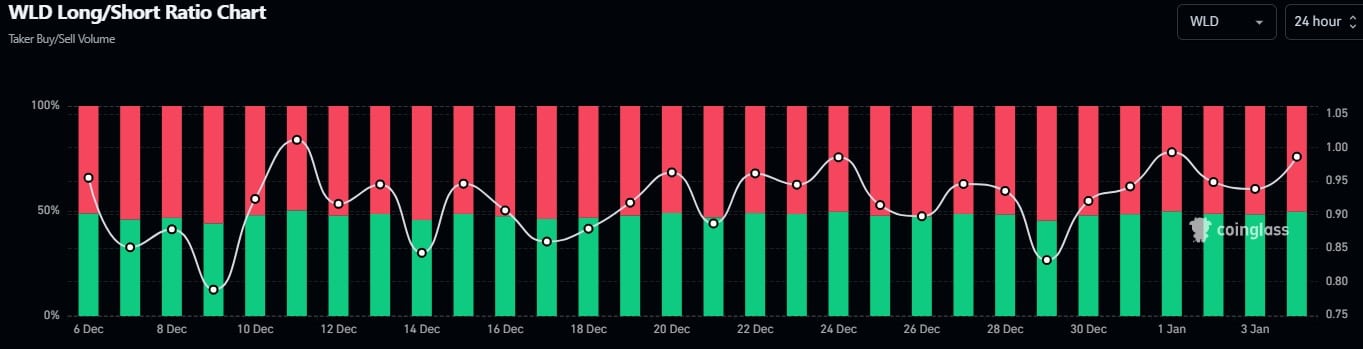

In fact, WLD’s Long/Short Ratio data from Coinglass indicated a progressive surge in the metric since the 29th of December.

This suggested that long position takers were taking control sluggishly, and could fuel a price recovery in the near future.

Source: Coinglass