- XRP’s whale activity surged, with the total supply held by whales with more than $5 million standing at 55%.

- Social dominance and liquidation levels paint a bullish picture.

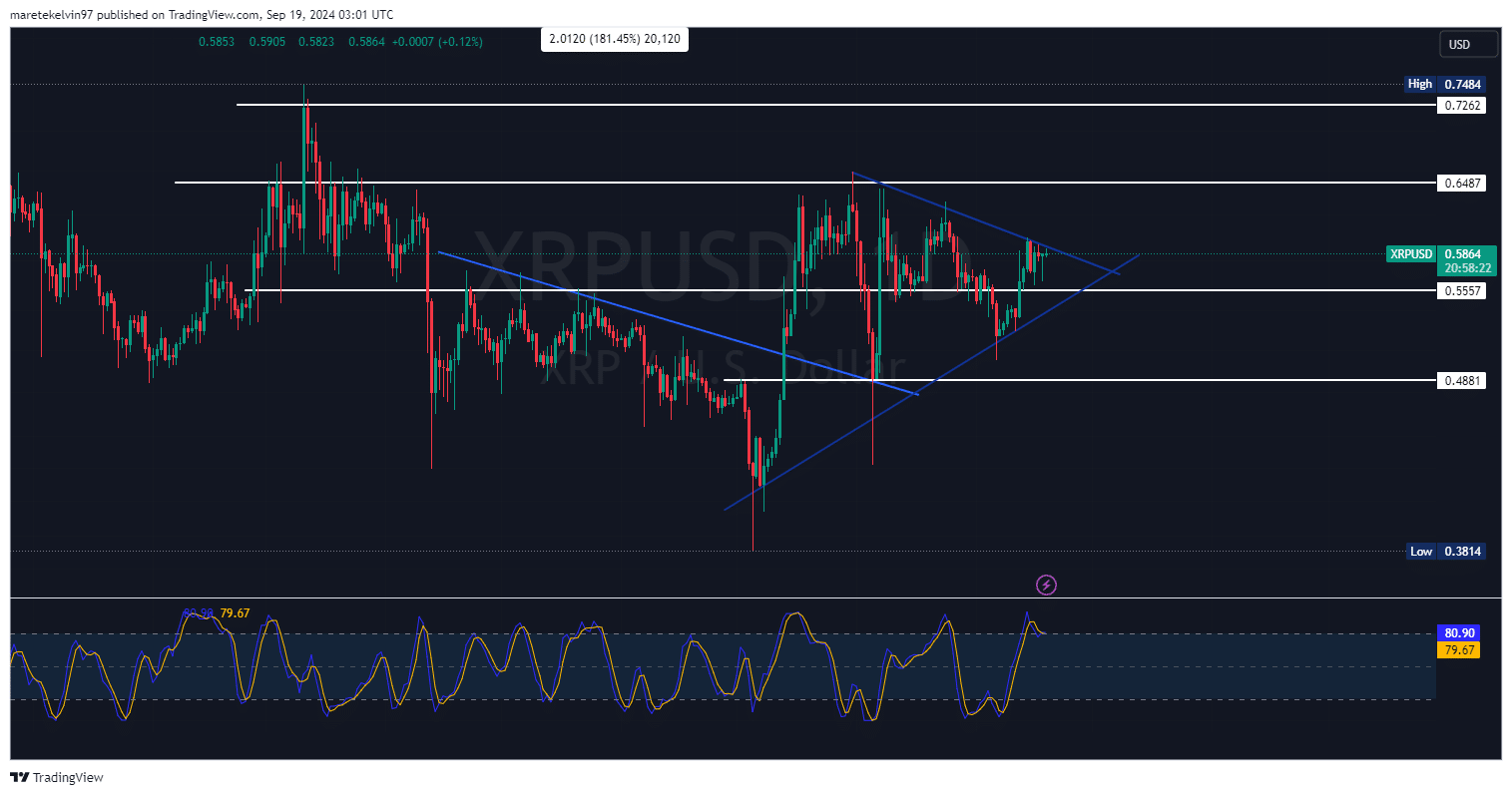

Ripple [XRP] has witnessed a phase of consolidation since early August. A symmetrical triangle pattern is evident from its daily price chart.

Recently, the altcoin prices have been on a bullish run since rejecting a key support level at $0.519 back in September.

As of this writing, XRP was testing a key symmetrical triangle resistance level at $0.58.

Source: Tradingview

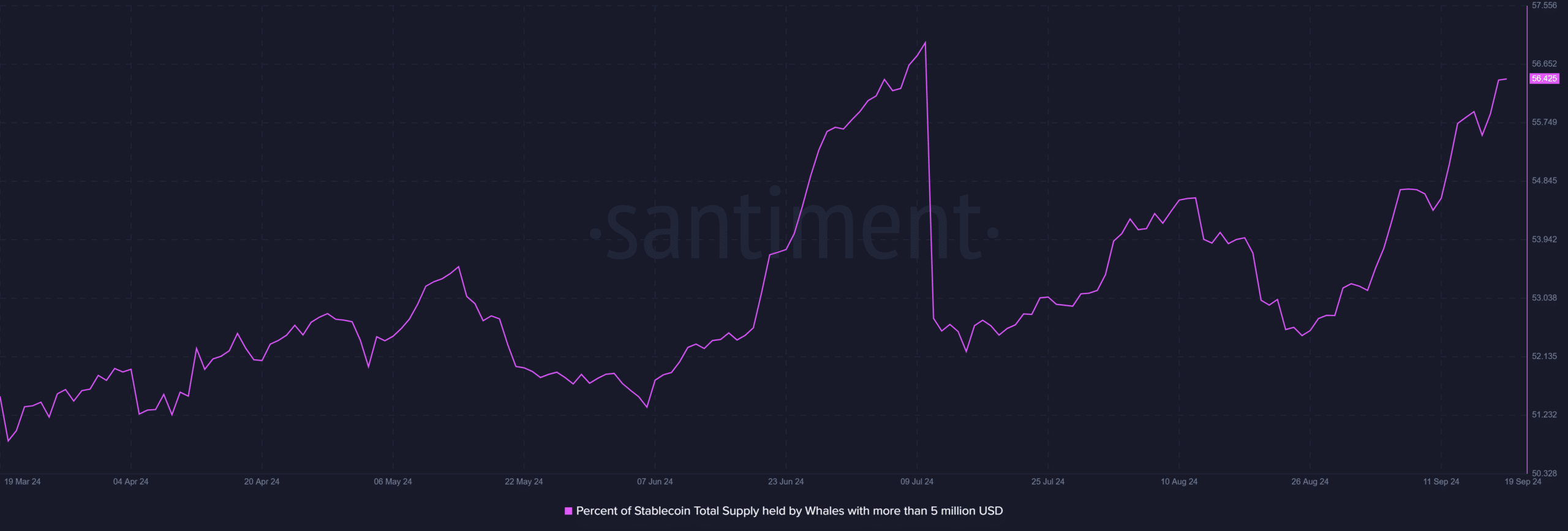

Whale dominance in XRP supply

Ripple’s whale activity has surged in the last 24 hours. According to the Santiment data, whales holding more than $5 million are currently in possession of 55% of the total supply.

The high level of concentration among a few major holders is an indication of wild swings that XRP’s market may experience in the near future.

Historically, whales have always played a role in the price action of XRP, and their dominance to this extent suggests a pivotal role in future market movements.

Source: Santiment

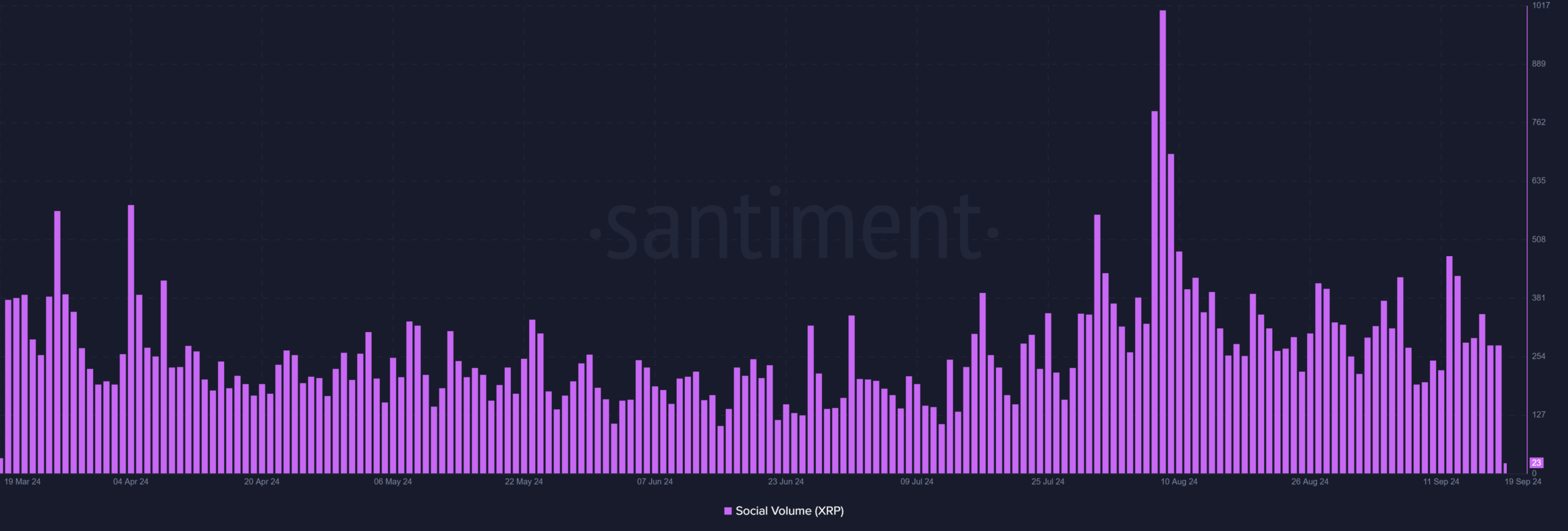

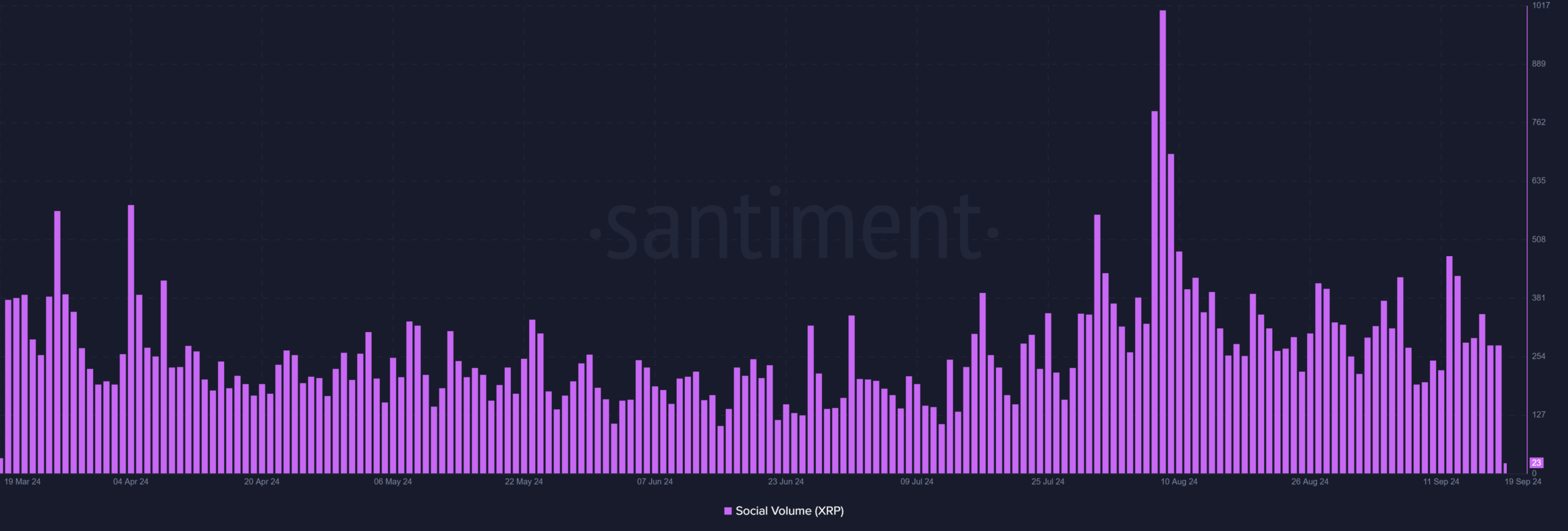

Social dominance on the rise

In addition to the whale activity, XRP social dominance has aggressively surged in the last couple of days. Increased discussions across social platforms often hint at greater interest or anticipation of significant events that may materialize in the markets.

These spikes in social activities could also push market momentum a notch higher as more traders and investors begin to pay attention to XRP.

Source: Santiment

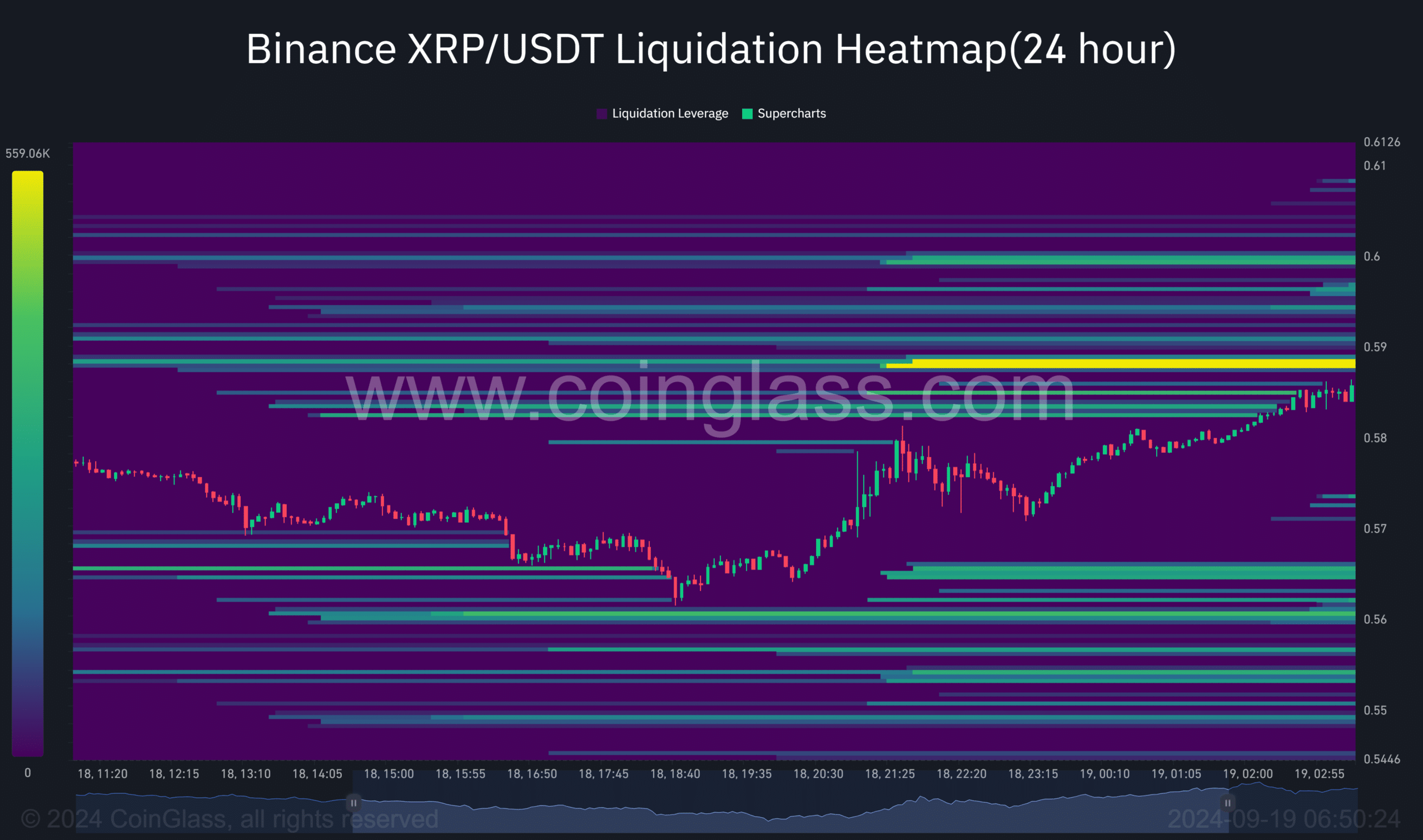

Looking further at the liquidation heatmap data from Coinglass, XRP indicates a clear bullish bias. A total of 559k XRP is pooled at the $0.5881 price level, indicating strong interest from buyers.

Source: Coinglass

Read XRP’s Price Prediction 2024–2025

This positive sentiment suggests increased confidence in the Ripple potential bullish rally, with investors taking long positions for further gains.

As XRP’s market metrics continue to improve, this combination of whale control, social dominance, and bullish liquidation may fuel further price action in the near future.